Trickle down economics is known by a number of names: supply side economics, Reaganomics, the Laffer Curve, voodoo economics, deregulation, Libertarianism, Mudsill Theory, Two Santa Claus theory, horse and sparrow theory, and the Trump tax cuts, to name a few. It has been espoused by everyone from Ayn Rand to Milton Friedman to Alan Greenspan to Gordon Gecko.

Trickle down economics involves focusing the brunt of government effort on helping the wealthy, at the expense of the middle class and the poor. The theory says that the wealthy elites of the country have proven themselves capable patricians for stewarding the lives of the masses through myth and fairytale in the name of patriotic duty. The “supply” in supply side are the rich, who will create companies that sell products to people who didn’t even realize they needed them. If we give enough of our collective tax pool to them, they say, they’ll create jobs and prosperity for everyone else.

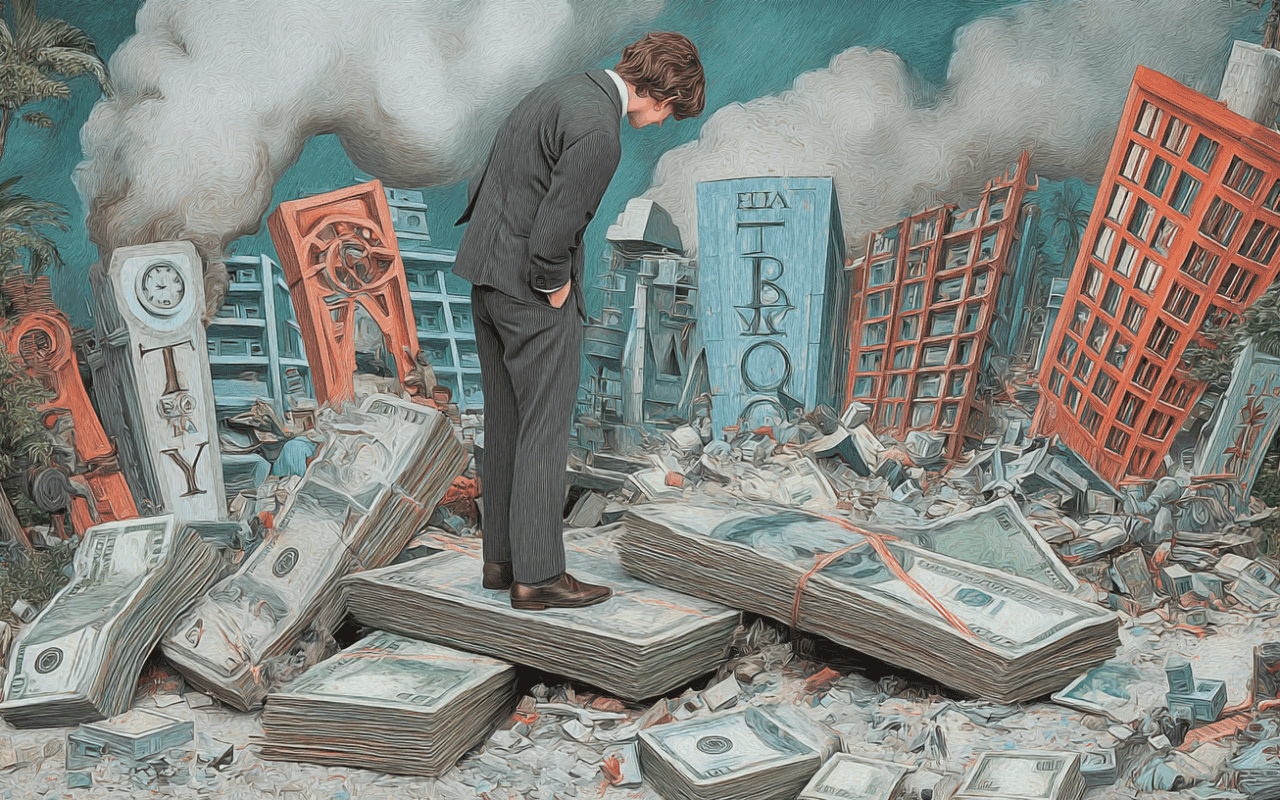

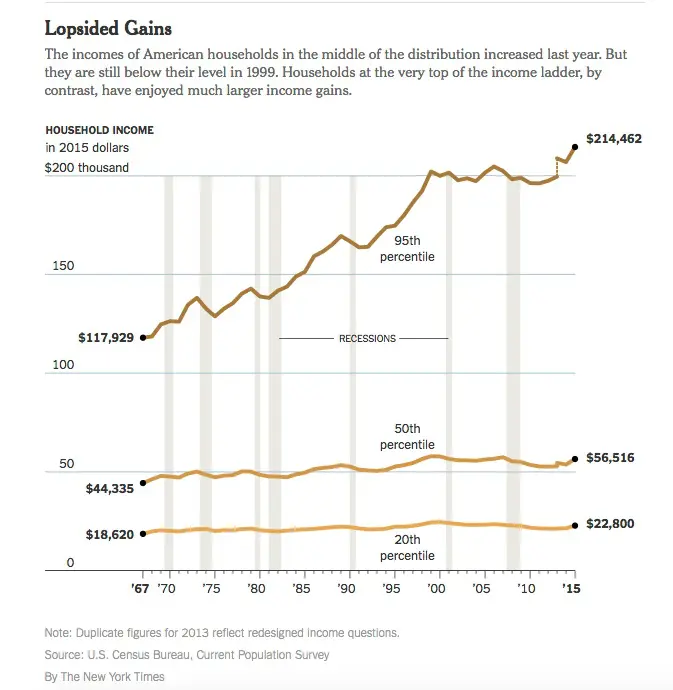

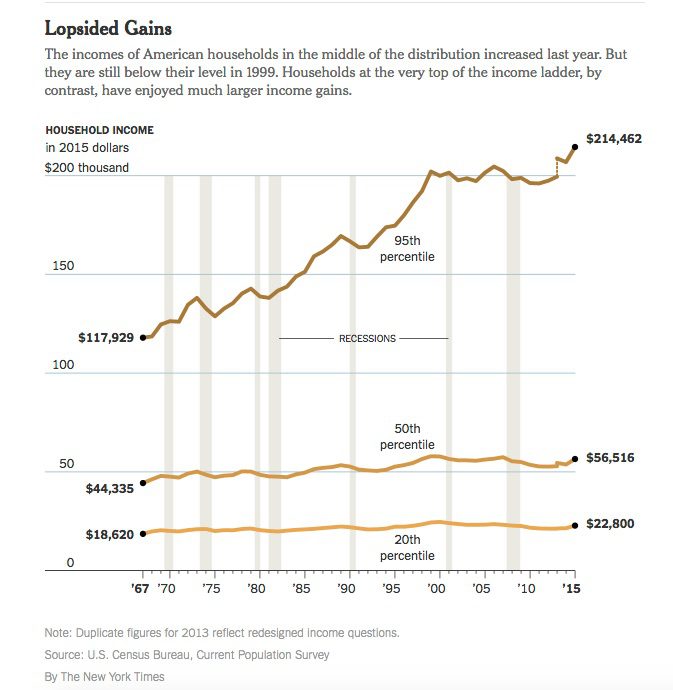

The problem for trickle down economics is that that isn’t true at all. It simply doesn’t happen. Time and time again over the past approximately 200 years, the ideology of rewarding the wealthy for being wealthy has proven its premises to be completely false. Deregulation and starving the government don’t produce a prosperous utopia — they produce recessions and depressions. They produce conglomerates too big to fail, that get rewarded for their brazenly irresponsible speculation with Main Street’s money, and flaunt their ability to simply capture government in our collective faces.

Trickle down economics since the 1970s

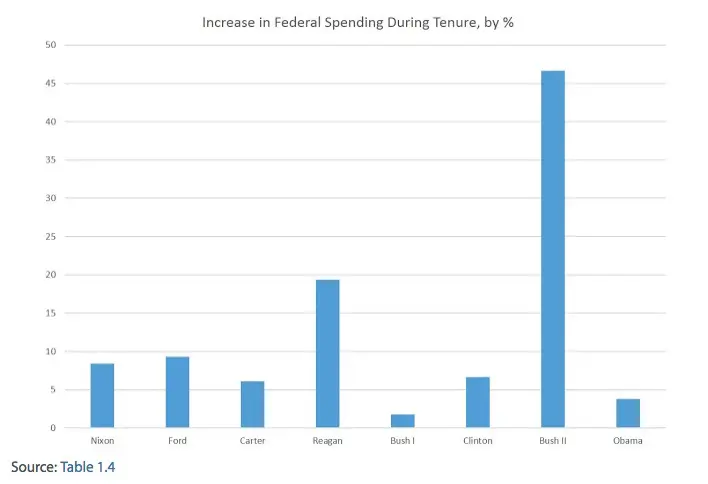

In its most recent incarnation as trickle-down, supply-side, or Reagonomics, tax cuts are pitched as paying for themselves when they have in actual fact succeeded in blowing up the deficit and the national debt. The work of Arthur Laffer and Jude Wanniski at a fateful meeting with Dick Cheney and Donald Rumsfeld in 1974, trickle-down economic theory was put into practice during the Reagan years and has been failing to produce the promised results of paying down the debt for almost half a century.

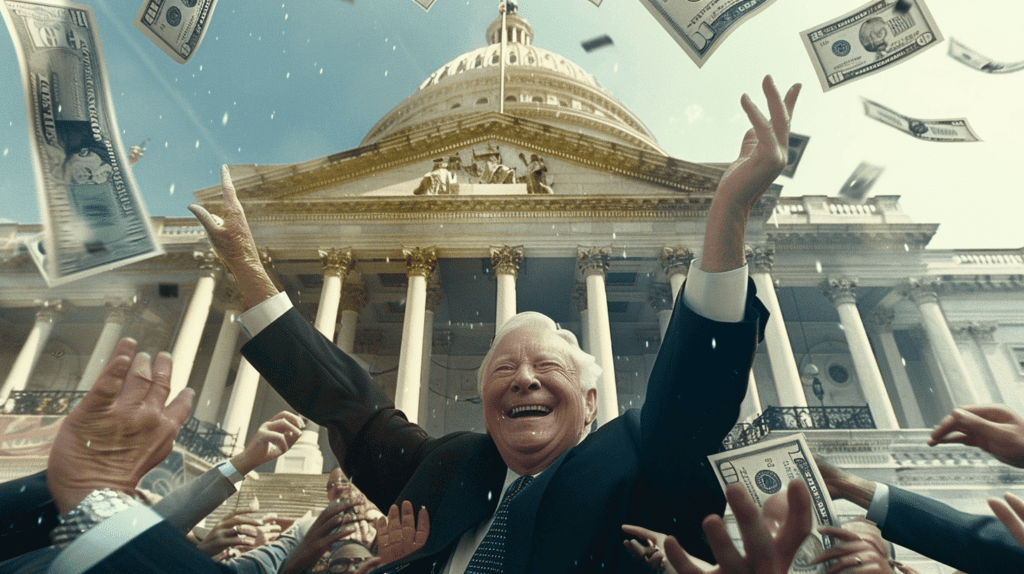

Jude Wanniski’s “Two Santa Claus” strategy laid the political groundwork for what would soon be branded as supply-side, or trickle-down, economics. Observing in the 1970s that Democrats played “Santa” by expanding popular social programs, Wanniski warned Republicans that positioning themselves as the party of spending cuts cast them as the “anti-Santa.” His fix was simple but potent: become a second Santa by promising sweeping tax cuts. Republicans, he argued, could shower voters with fiscal “gifts” while leaving beloved programs intact, sidestepping the backlash that traditionally followed austerity talk.

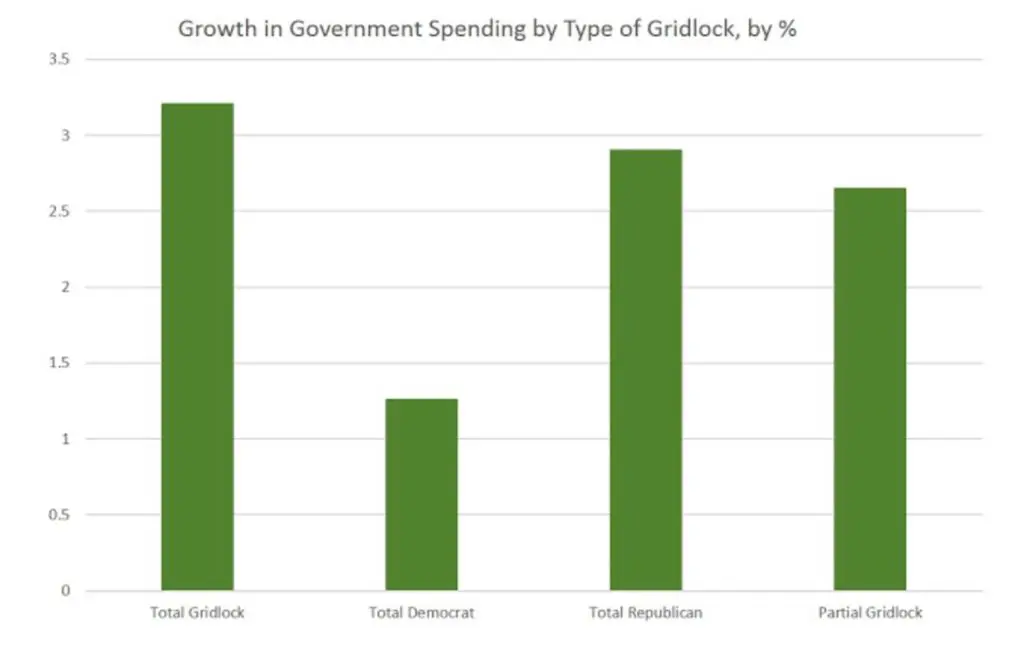

This tactical reframing meshed perfectly with the emerging supply-side creed. By asserting that lower taxes on corporations and high earners spur investment, production, and ultimately broad prosperity, Republicans could claim that their giveaways weren’t merely political theater—they were an economic necessity. The brilliance (and cynicism) of the scheme was its indifference to short-term deficits: ballooning red ink would corner future Democratic administrations into either raising taxes or cutting spending, both politically toxic options.

In practice, the Two Santa Claus playbook flipped classical, demand-driven thinking on its head. Rather than boosting middle-class wages to stoke consumption, it poured resources into the top of the income ladder and trusted prosperity to “trickle down.” The approach reached full throttle in the Reagan era—taxes slashed, spending still high—and its legacy endures: chronic deficits, rising inequality, and an ongoing partisan tug-of-war over who pays the bill.

The Big, Beautiful, Debt-Ballooning Bill

Look no further than the monstrosity of a bill the Republicans are trying to jam through the reconciliation process. Expected to make the 2017 Trump tax cuts a permanent welfare handout to the wealthiest billionaires on the planet, the so-called “Big, Beautiful Bill” is also slated to add $4 trillion to the national debt.

We can’t keep going on this way.

It’s long past time we undertake the difficult work of educating the population more broadly about this GOP economics scam that’s been running for the past 50 years and running up the till while nurturing a truly nasty partisan political divide as insult to injury.

Trickle down doesn’t work. Tax cuts to billionaires doesn’t work — at least, not for anyone other than the billionaires and political elite class. We need an economic system that works broadly for everyone, otherwise sooner or later it all comes crashing down and we are in for a (literal) world of hurt.

Related concepts:

- property vs. people

- wealth cult

- Jude Wanniski — Two Santa Claus Theory

- James Henry Hammond — Mudsill Theory

- Horse and sparrow theory

- The Austrian School — Friedrich Hayek, Ludwig von Mises, Milton Friedman

- Reaganomics

- The Laffer Curve

- deregulation

- “drown it in the bathtub” — Grover Norquist

- inequality

- The Gilded Age

- robber barons

- Citizens United