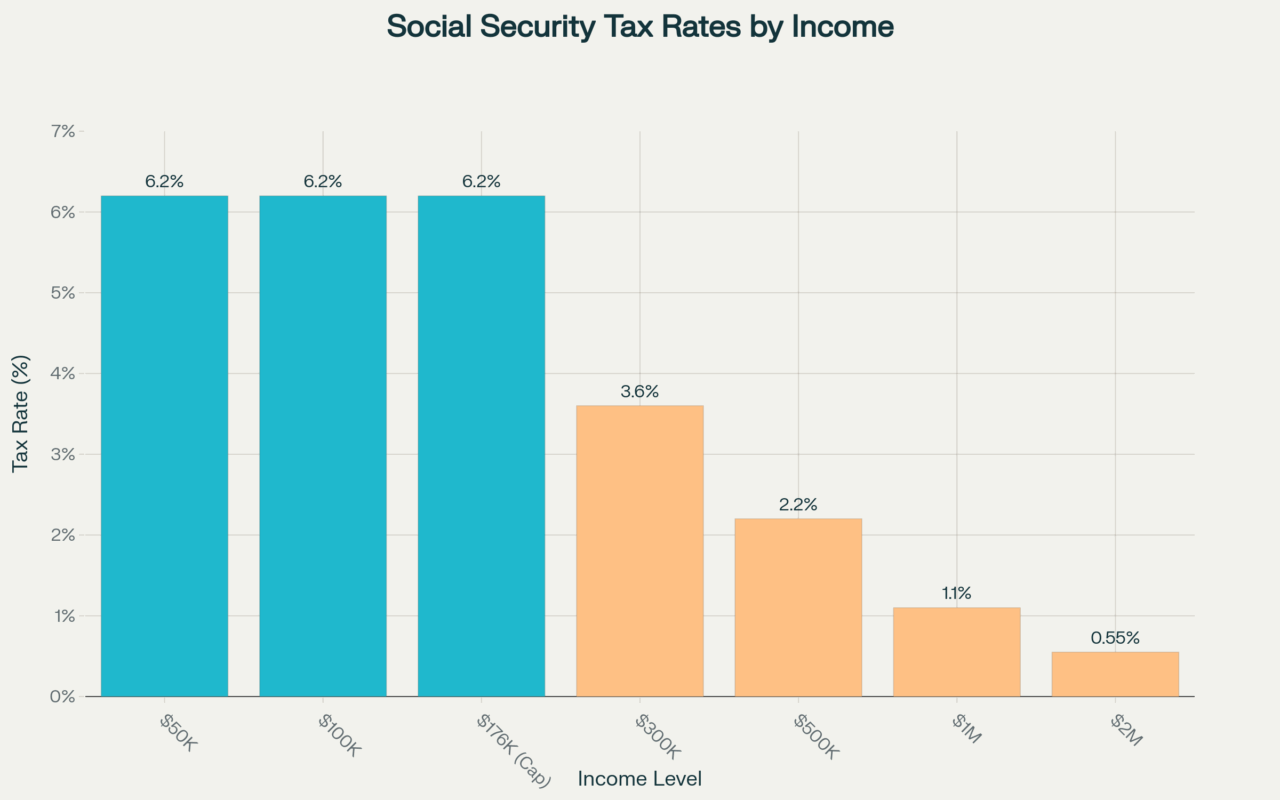

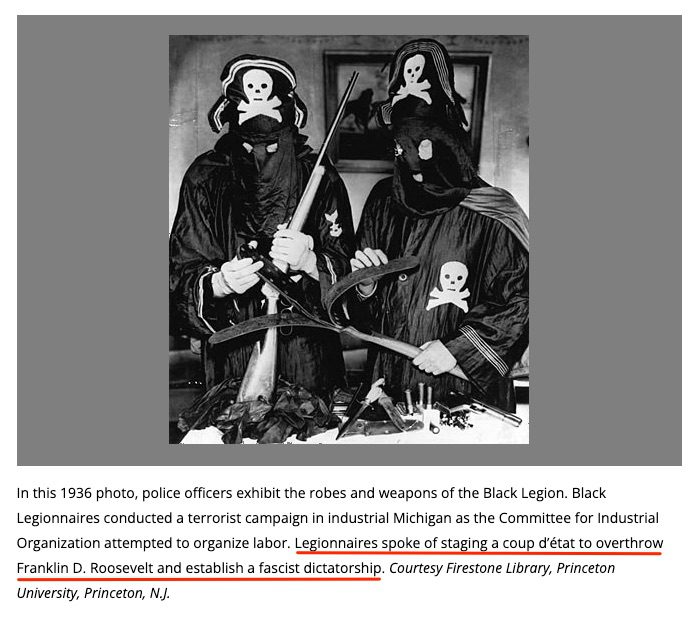

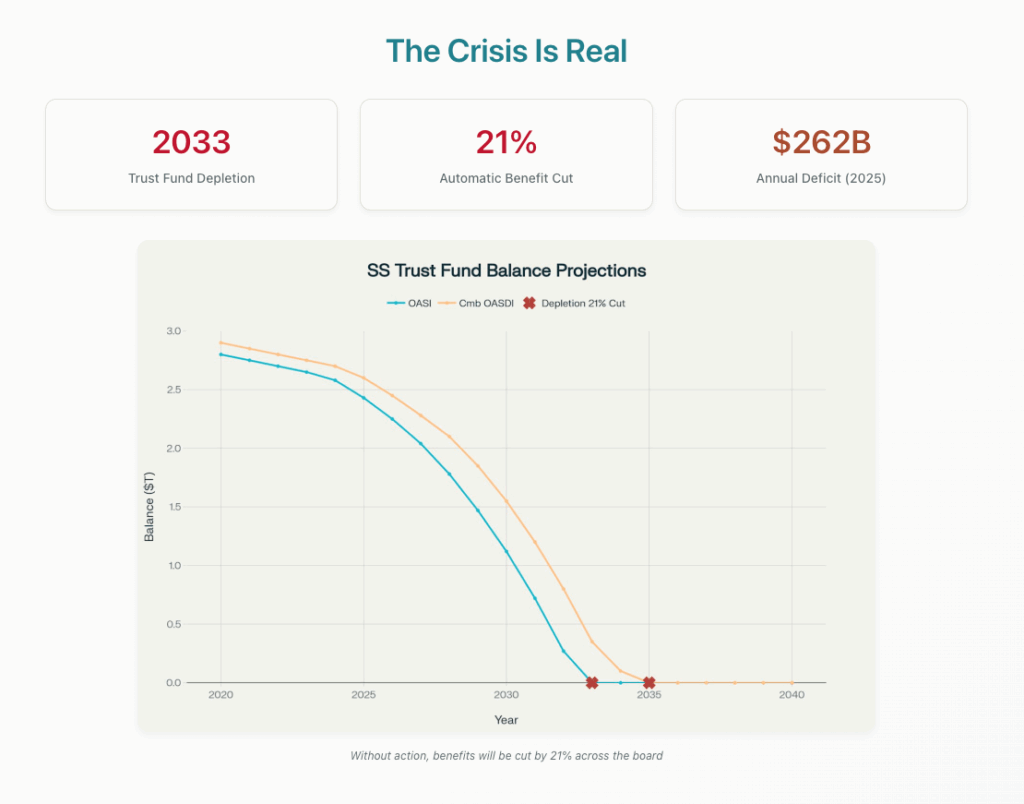

Social Security stands at a crossroads. With the trust fund set to run dry by 2033, millions of Americans face the prospect of automatic 21% benefit cuts unless Congress acts decisively. Yet while politicians debate painful across-the-board sacrifices, a targeted solution sits in plain sight: we could easily save social security by lifting the salary cap that currently shields high earners from paying Social Security taxes on income above $176,100.

By requiring wealthy Americans to pay the same tax rate on their entire income that middle-class families already do, we could generate hundreds of billions in new revenue and close up to 80% of the program’s funding gap—without touching benefits or raising taxes on 98% of workers. The math is clear, the solution is fair, and the time for action is now.

I’ve been playing with the new Perplexity Labs features — just one example of May’s action-packed AI announcement extravaganza — and asked it to come up with a “persuasive presentation” for illustrating how easily Social Security could be funded if we raise the salary cap for paying into it, allowing high-earning individuals to pay their fair share. I was incredibly impressed with what it came up with. I’ve embedded it below — just click on the image to launch the presentation in lightbox mode:

Here’s the prompt:

can you create a persuasive presentation that shows how social security could be kept solvent if we raise the salary cap at which people stop paying in to the system? dig in to all the financials of the current system, and explain how it is funded, to illustrate this