Saving Social Security

The Case for Lifting the Salary Cap

A Fair Solution to Ensure Benefits for 67+ Million Americans

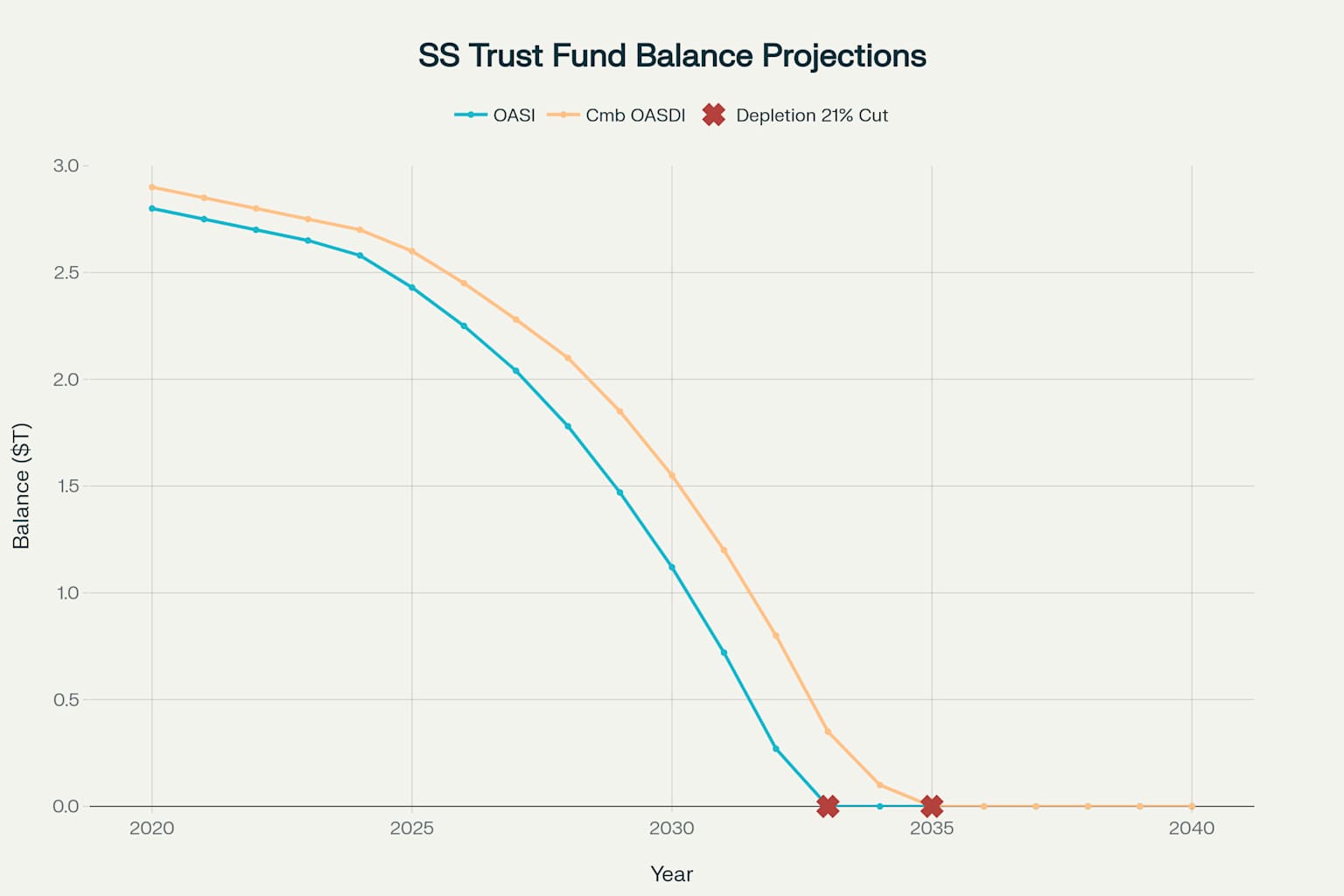

The Crisis Is Real

2033

Trust Fund Depletion

21%

Automatic Benefit Cut

$262B

Annual Deficit (2025)

Without action, benefits will be cut by 21% across the board

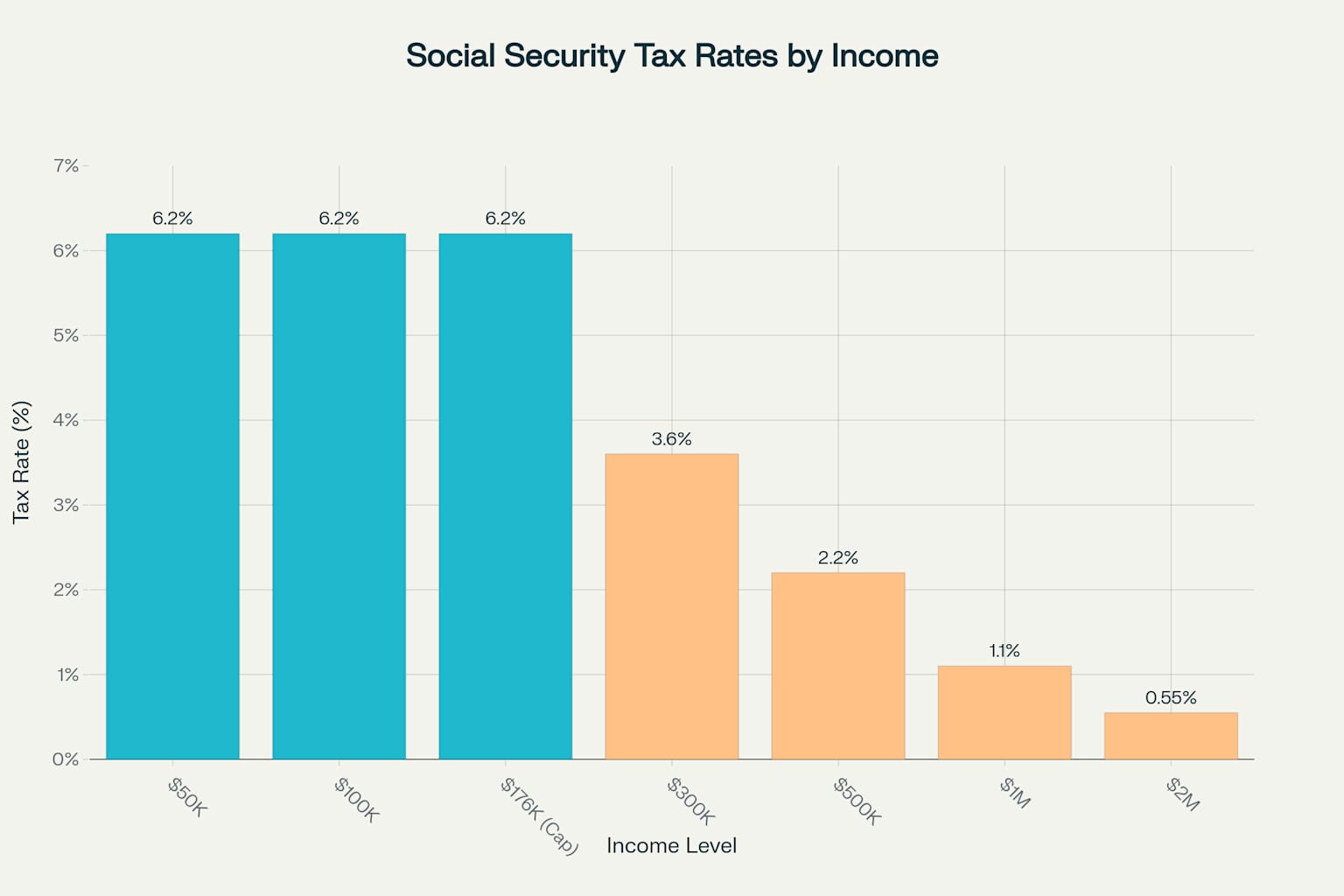

How Social Security Works Today

Current Funding System

- 6.2% tax on wages (employee)

- 6.2% tax on wages (employer)

- 12.4% total contribution

- Cap at $176,100 (2025)

The Problem

- Only 6% of workers earn above the cap

- High earners pay lower effective rates

- Cap covers declining share of total wages

- System becomes increasingly regressive

Result: Someone earning $2 million pays the same Social Security tax as someone earning $176,100

The Tax Is Regressive

Higher earners pay lower effective Social Security tax rates

Middle Class Worker ($50K): Pays 6.2% effective rate

High Earner ($2M): Pays 0.55% effective rate

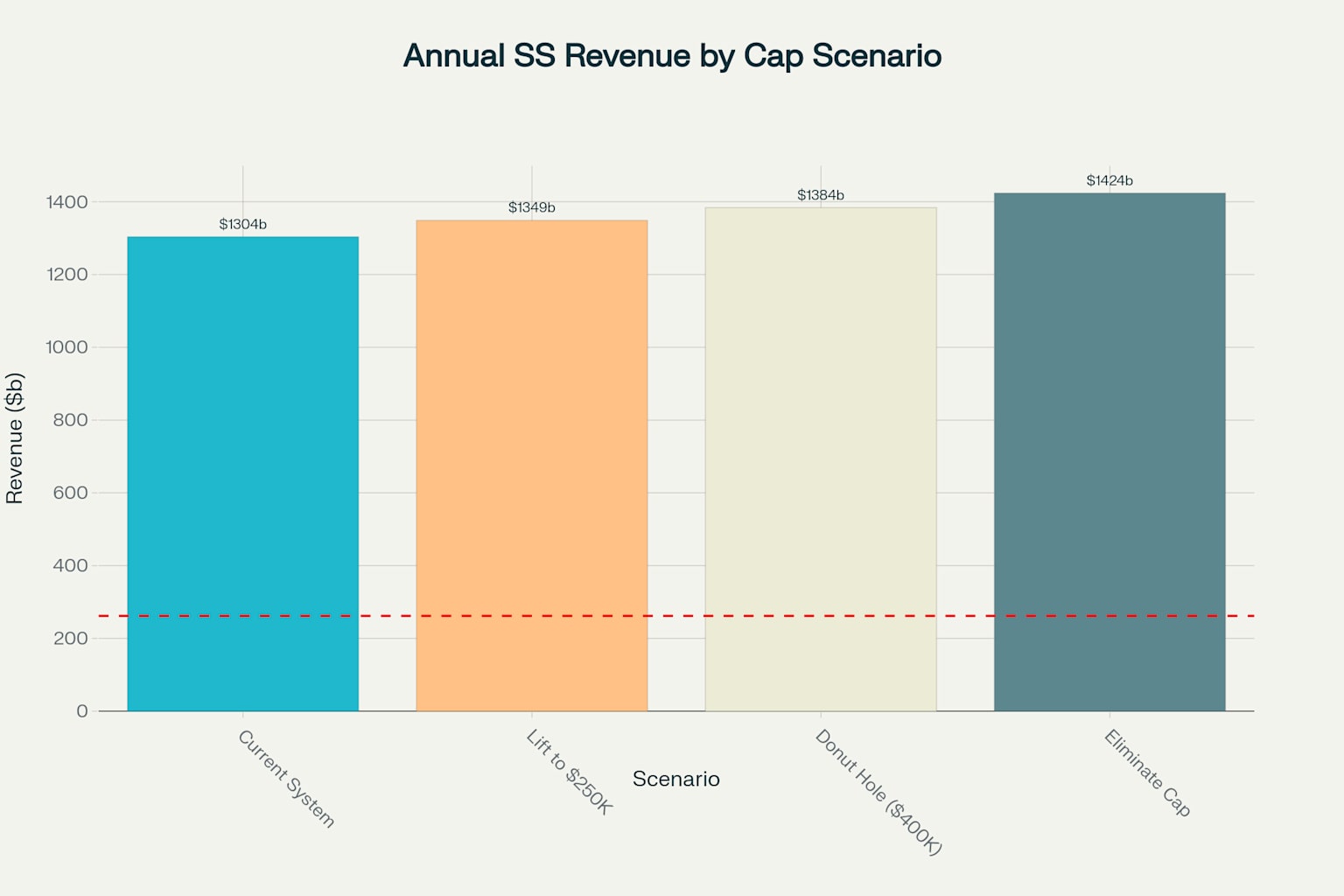

Fair Solutions

Donut Hole Approach

- Apply tax to income above $400,000

- Affects top 1-2% of earners

- Generates ~$205B annually

- Closes 60-80% of deficit

Eliminate Cap Entirely

- Remove the cap completely

- Affects top 6% of earners

- Generates ~$293B annually

- Nearly eliminates deficit

Recommended

Revenue Impact

How much additional revenue each approach generates

Current System: $262B annual deficit

Eliminating the Cap: Nearly closes the entire gap

Who Would Pay More?

94% of Workers

NO CHANGE

Earning under $176,1006% of Workers

Pay Fair Share

Earning over $176,100Real Impact Examples:

$300K earner: Additional $7,681/year

$500K earner: Additional $20,081/year

$1M earner: Additional $51,081/year

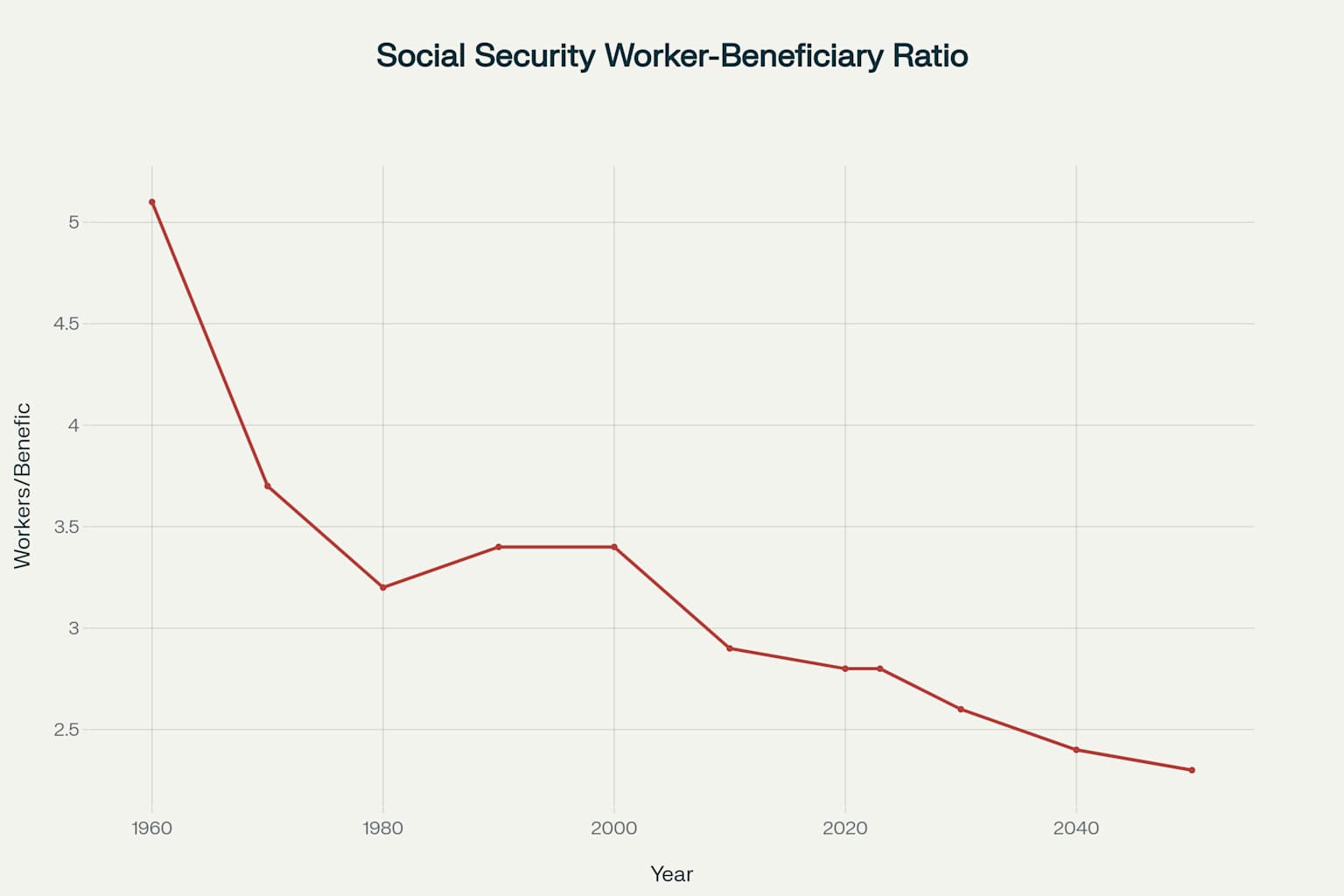

The Demographic Challenge

Fewer workers supporting each retiree

1960: 5.1 workers per beneficiary

Today: 2.8 workers per beneficiary

2035: 2.3 workers per beneficiary

We need every worker to pay their fair share

The Choice Is Clear

Do Nothing

- 21% benefit cuts in 2033

- 67+ million Americans hurt

- $4,980 less per year for median beneficiary

- System remains regressive

Lift the Cap

- Full benefits preserved

- System becomes more fair

- Only high earners pay more

- Nearly eliminates the deficit

It's Time to Act

Contact your representatives and demand they lift the Social Security salary cap. 67 million Americans are counting on it.