Social Security stands at a crossroads. With the trust fund set to run dry by 2033, millions of Americans face the prospect of automatic 21% benefit cuts unless Congress acts decisively. Yet while politicians debate painful across-the-board sacrifices, a targeted solution sits in plain sight: we could easily save social security by lifting the salary cap that currently shields high earners from paying Social Security taxes on income above $176,100.

By requiring wealthy Americans to pay the same tax rate on their entire income that middle-class families already do, we could generate hundreds of billions in new revenue and close up to 80% of the program’s funding gap—without touching benefits or raising taxes on 98% of workers. The math is clear, the solution is fair, and the time for action is now.

I’ve been playing with the new Perplexity Labs features — just one example of May’s action-packed AI announcement extravaganza — and asked it to come up with a “persuasive presentation” for illustrating how easily Social Security could be funded if we raise the salary cap for paying into it, allowing high-earning individuals to pay their fair share. I was incredibly impressed with what it came up with. I’ve embedded it below — just click on the image to launch the presentation in lightbox mode:

Here’s the prompt:

can you create a persuasive presentation that shows how social security could be kept solvent if we raise the salary cap at which people stop paying in to the system? dig in to all the financials of the current system, and explain how it is funded, to illustrate this

And here’s the full result output:

Saving Social Security: The Financial Case for Lifting the Salary Cap

Social Security faces an unprecedented financial crisis that threatens to cut benefits for 67 million Americans within the next decade. However, a straightforward solution exists that could preserve the program’s solvency while asking only the highest earners to pay their fair share: lifting the salary cap on Social Security taxes. This analysis demonstrates how targeted increases to the payroll tax ceiling could generate hundreds of billions in additional revenue, potentially closing 60-80% of the program’s long-term deficit without affecting middle-class workers.

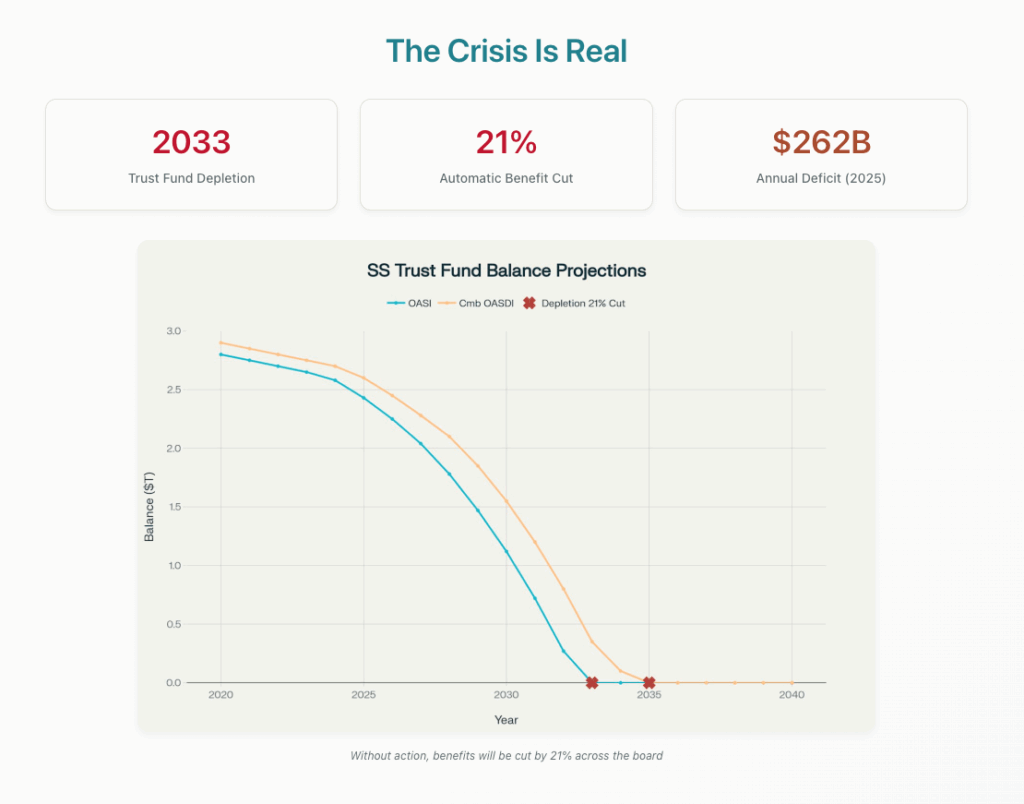

The Looming Crisis: Trust Fund Depletion by 2033

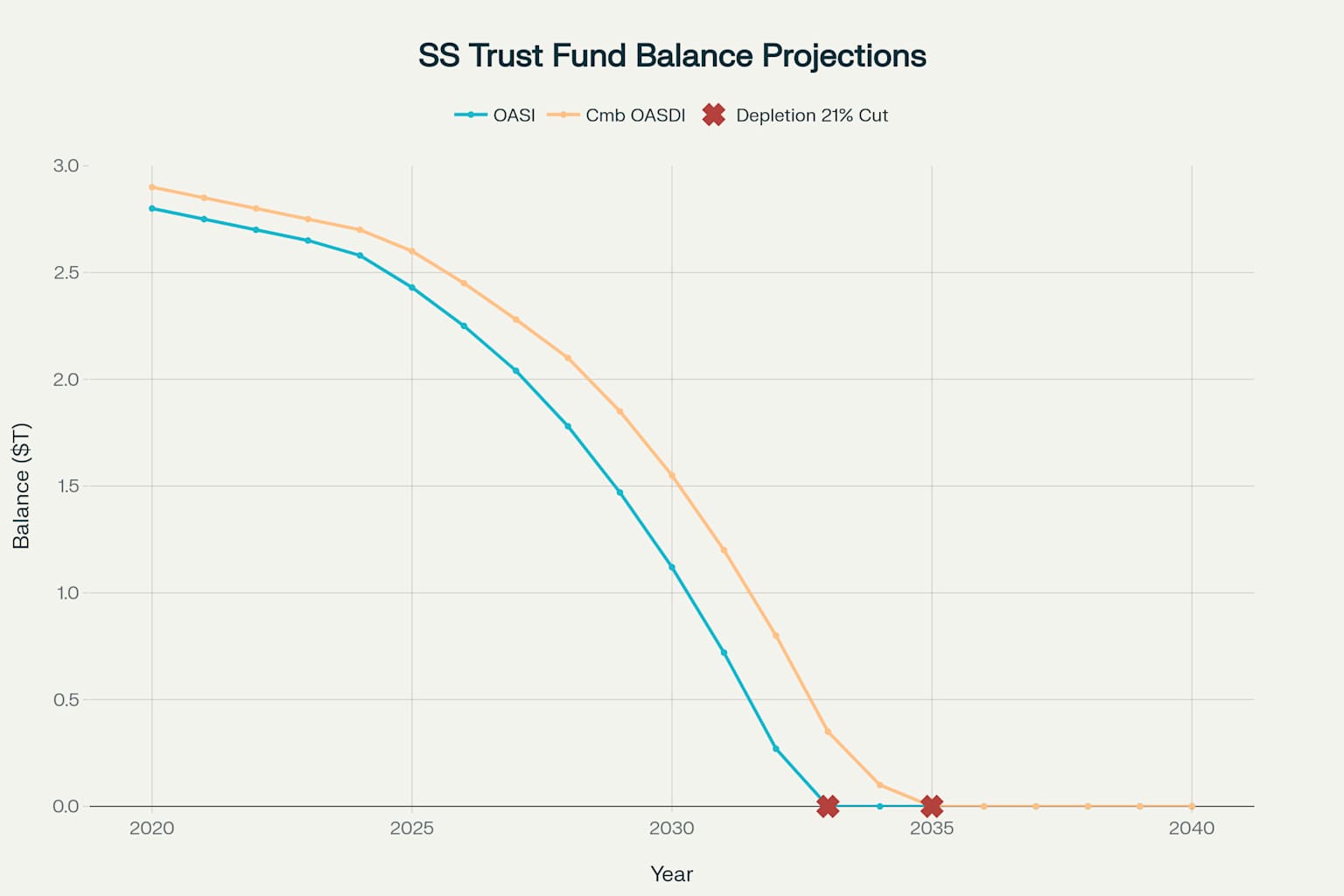

Social Security’s Old-Age and Survivors Insurance (OASI) trust fund is projected to be completely depleted by 2033, just eight years from now 1319. When this occurs, the program will only be able to pay 79% of scheduled benefits, resulting in an immediate 21% cut for all recipients 1115. This would reduce the average annual Social Security benefit from $23,712 to approximately $18,732, cutting $4,980 from retirees’ income when they can least afford it 35.

The combined Old-Age, Survivors, and Disability Insurance (OASDI) trust funds are projected to be exhausted by 2035, at which point beneficiaries would face a 17% reduction in benefits 5153. The scale of this crisis is staggering: Social Security faces a 75-year deficit of $23 trillion, with annual shortfalls growing from $262 billion in 2025 to much larger amounts as baby boomers continue retiring 5135.

Social Security Trust Fund Balance Projections: The Approaching Crisis

How Social Security is Currently Funded

Social Security operates as a pay-as-you-go system where current workers’ payroll taxes fund current beneficiaries’ benefits 6. The program is primarily financed through the Federal Insurance Contributions Act (FICA) taxes, with employees and employers each contributing 6.2% of wages, for a combined rate of 12.4% 810. Self-employed individuals pay the full 12.4% rate but can deduct half as a business expense 8.

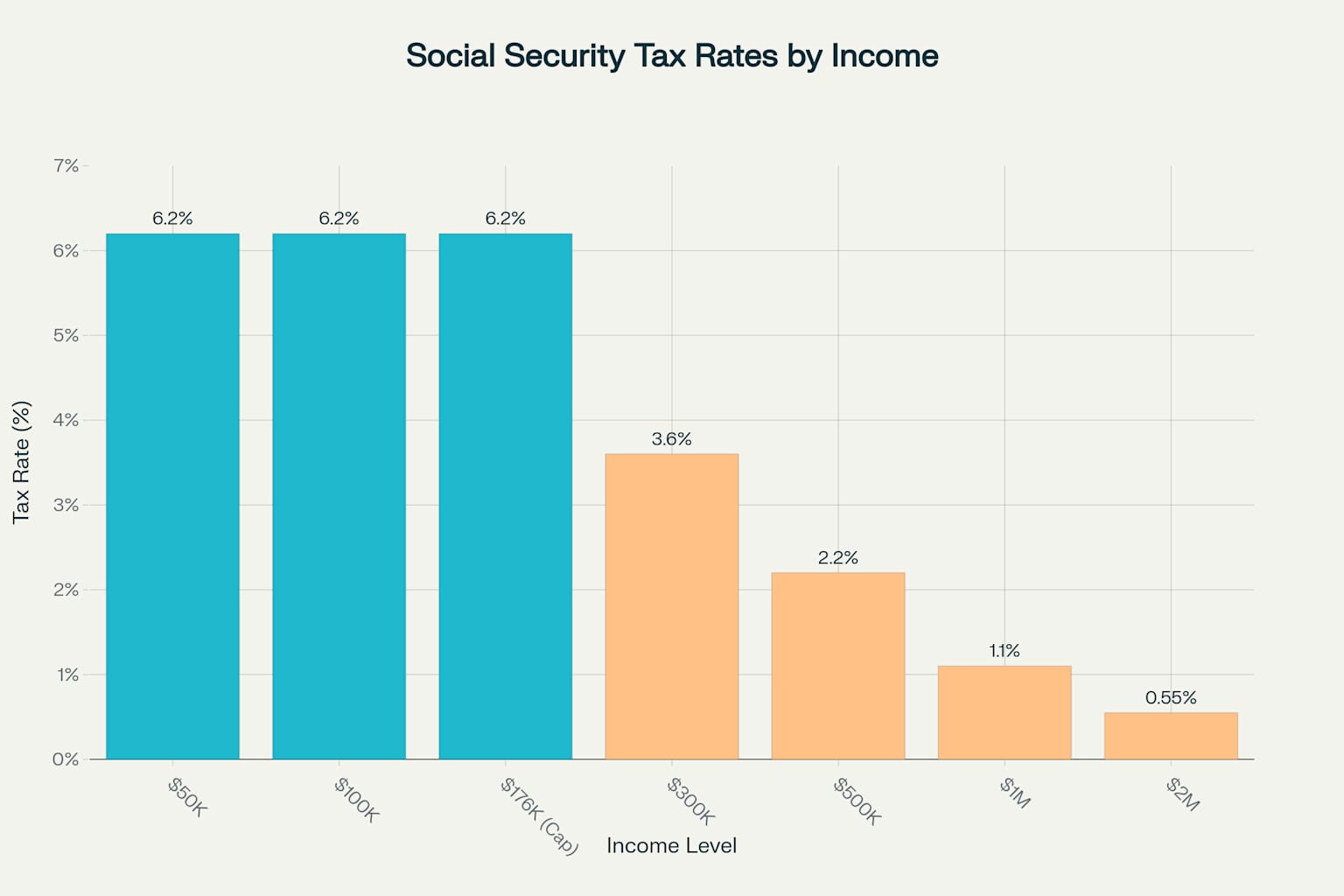

The Current Salary Cap System

Crucially, Social Security taxes are only applied to earnings up to a specific annual limit, known as the taxable maximum or salary cap 33. For 2025, this cap is set at $176,100, meaning any income above this amount is exempt from Social Security taxes 14. The cap is adjusted annually based on growth in the national average wage index 2546.

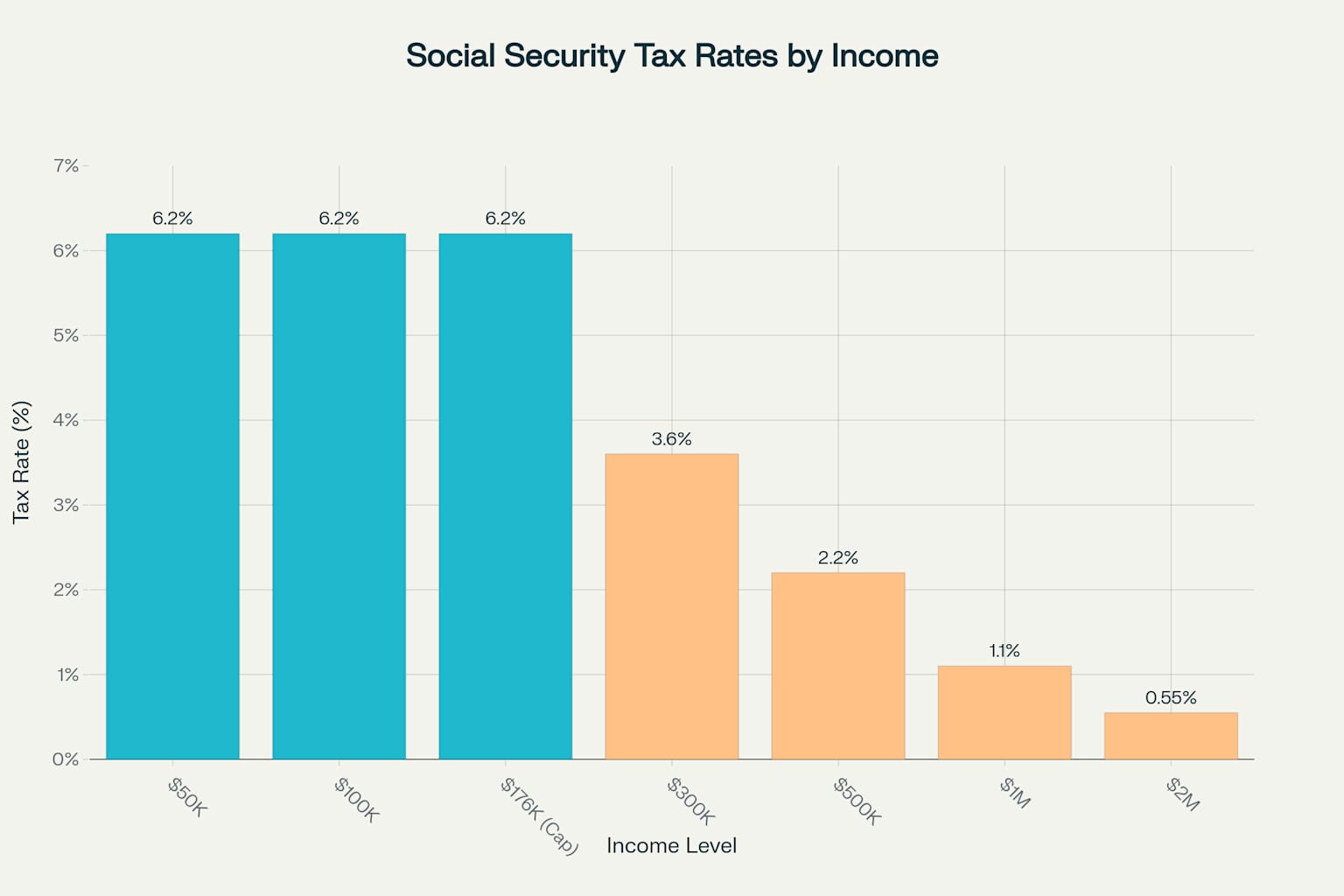

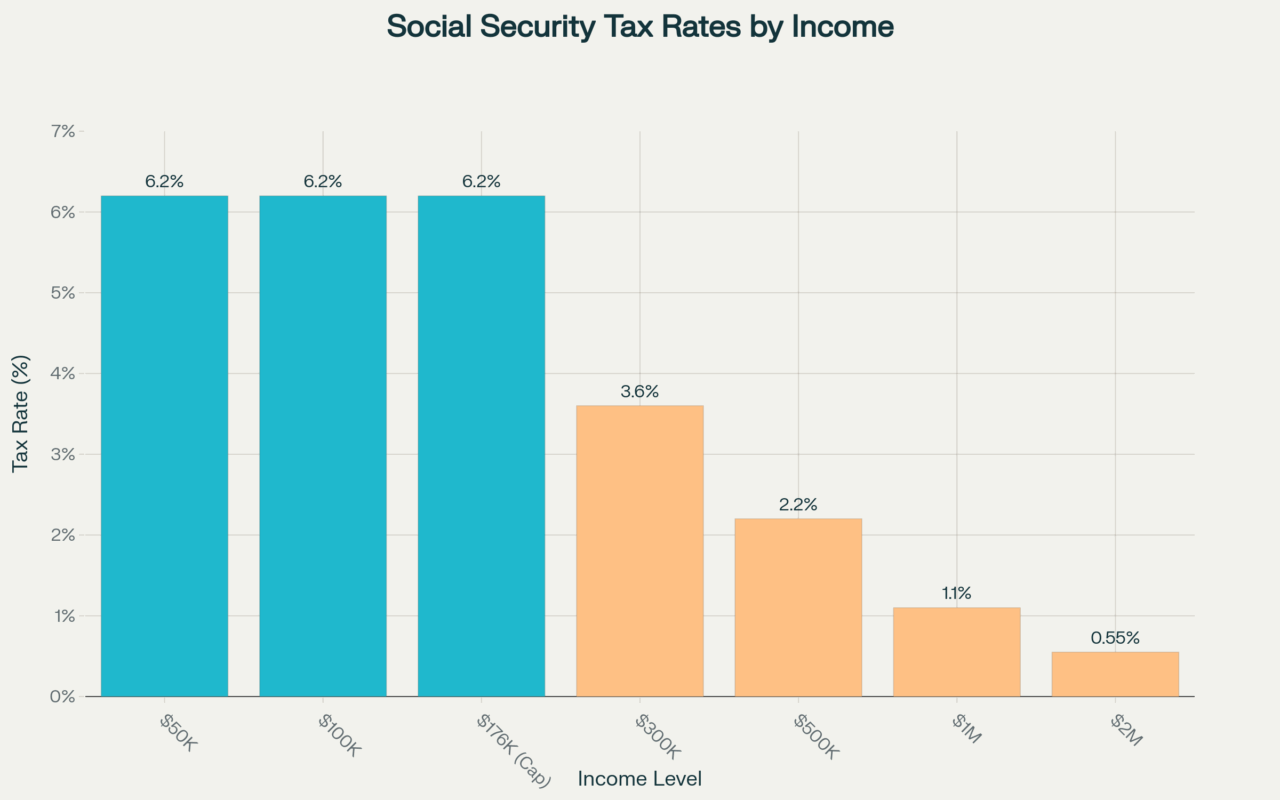

Under the current system, a worker earning $50,000 pays $3,100 annually in Social Security taxes (6.2% of their entire income), while someone earning $2 million pays only $10,918 – the same amount as someone earning exactly $176,100 1. This creates a regressive tax structure where high earners pay progressively lower effective rates as their income increases.

The Inequality Problem: A Regressive Tax Structure

The salary cap creates a fundamentally unfair tax system that contradicts Social Security’s progressive benefit structure. While the program provides higher replacement rates for lower-income workers through its benefit formula, the financing mechanism becomes less progressive at higher income levels 2730.

Research from the Economic Policy Institute shows that a record share of earnings was not subject to Social Security taxes in 2021, with inequality undermining the system’s financing 30. Approximately 6% of workers – roughly 10.6 million Americans – earn above the current cap, meaning their excess income escapes Social Security taxation entirely 2933.

Social Security Tax is Regressive: Higher Earners Pay Lower Effective Rates

The effective tax rates demonstrate this regressive structure starkly. A middle-class worker earning $100,000 pays 6.2% of their income in Social Security taxes, while a millionaire pays only 1.09% of their total income to the program 31. This violates basic principles of tax fairness and leaves significant revenue on the table while the system faces insolvency.

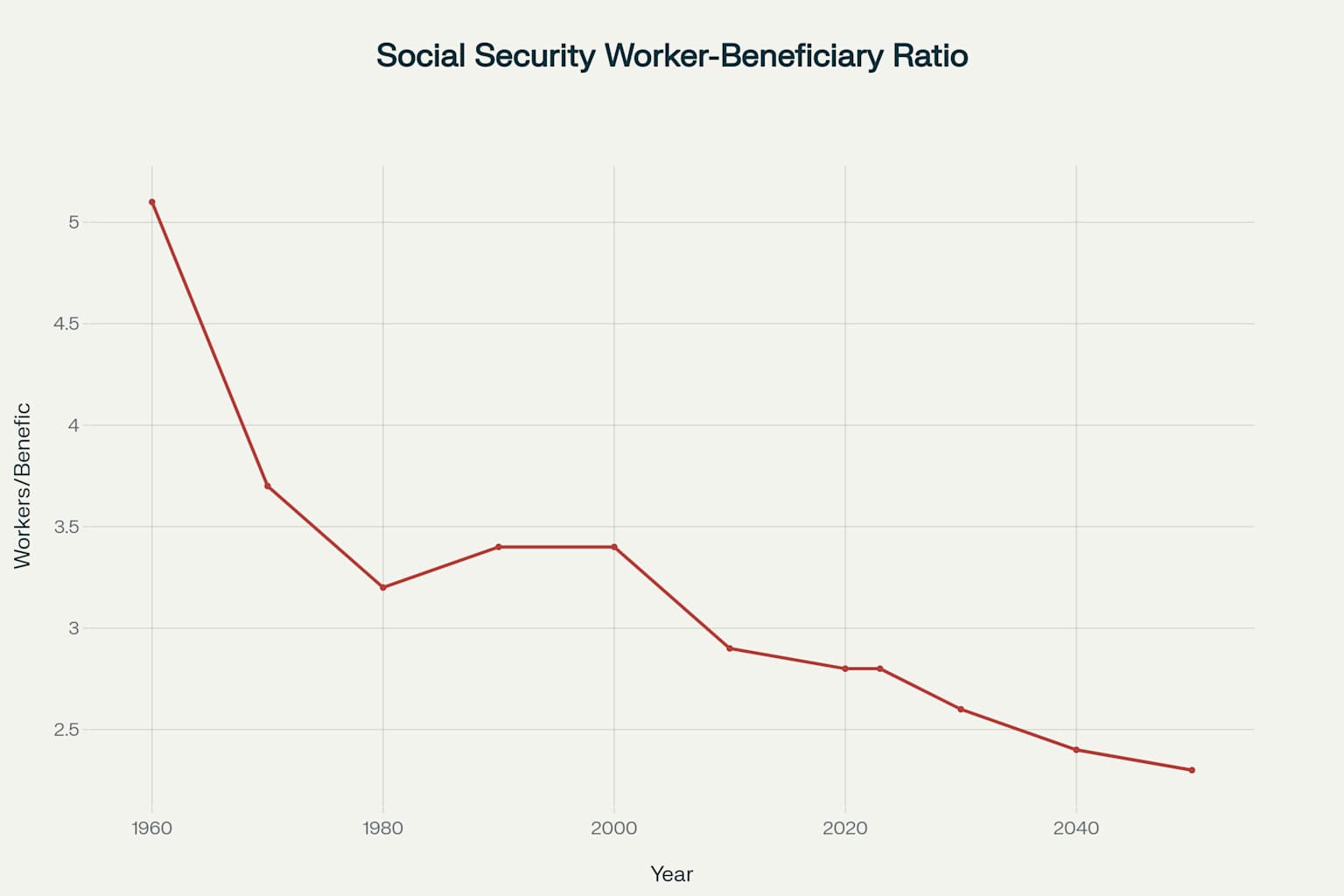

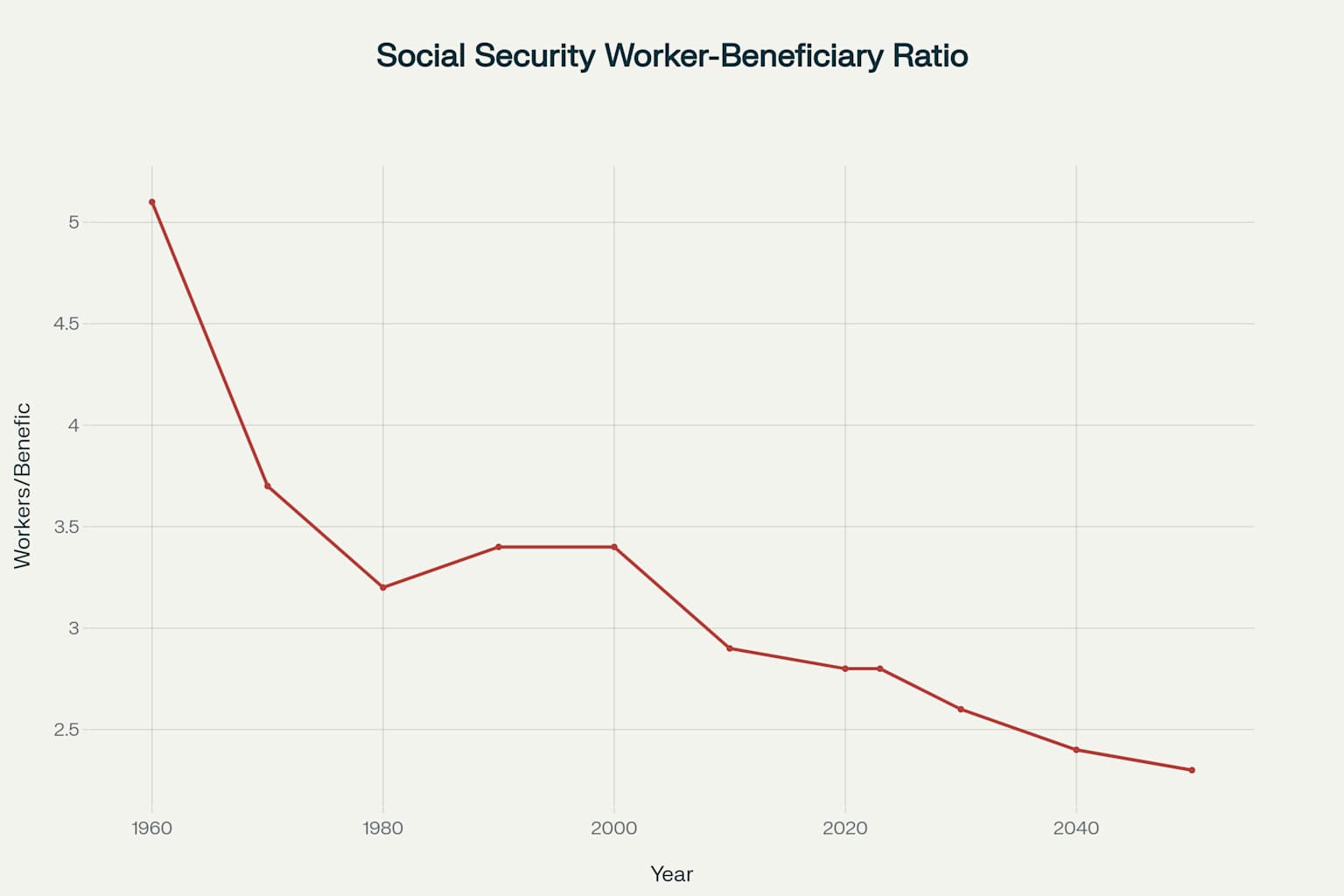

Demographic Pressures Intensifying the Crisis

The financial pressures on Social Security are intensified by dramatic demographic changes that have fundamentally altered the ratio of workers to beneficiaries. In 1960, there were more than five workers paying into the system for every beneficiary 51. By 2023, this ratio had declined to approximately 2.6 workers per beneficiary, and it is projected to fall to just 2.3 workers per beneficiary by 2050 51.

The Demographic Challenge: Declining Worker-to-Beneficiary Ratio

This demographic shift reflects the retirement of the baby boom generation, with about 10,000 Americans turning 65 every day since 2010 11. The aging population means more people drawing benefits while fewer workers support each beneficiary, creating structural pressure that requires either benefit cuts, tax increases, or both.

The Solution: Lifting the Salary Cap

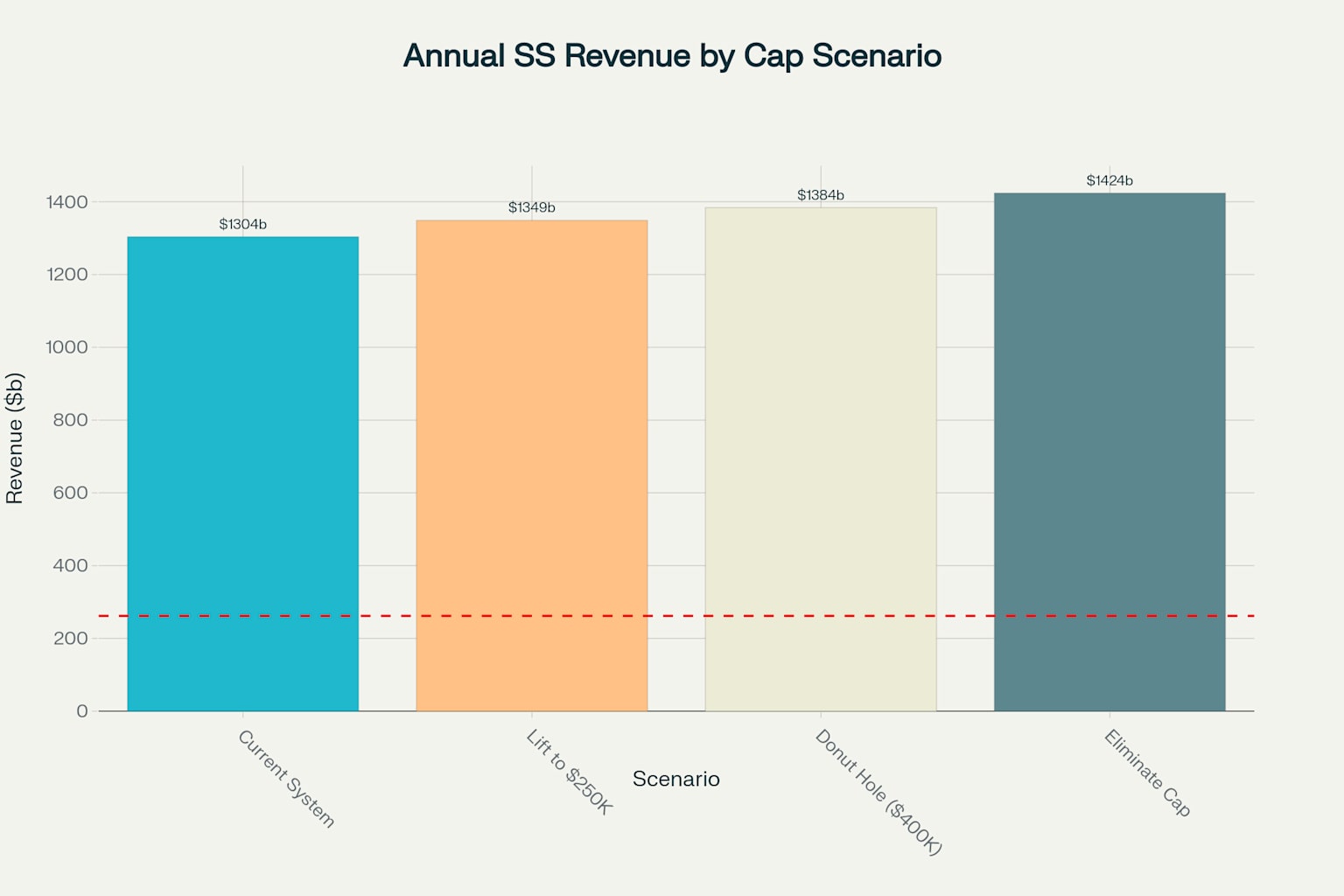

Multiple policy proposals exist to address Social Security’s financing crisis by lifting or eliminating the salary cap, each offering different approaches to generating additional revenue while maintaining the program’s progressive structure.

The “Donut Hole” Approach

The most politically viable proposal involves creating a “donut hole” in Social Security taxation by applying the payroll tax to income above $400,000 while maintaining the current cap for income between $176,100 and $400,000 4749. This approach would affect only the top 1-2% of earners while generating substantial revenue.

Under this scenario, a worker earning $500,000 would pay Social Security taxes on their first $176,100 of income and on the $100,000 above $400,000, but not on the $223,900 in between 2124. This targeted approach could generate approximately $205 billion in additional annual revenue and close 60-80% of Social Security’s 75-year deficit.

ss_analysis_data.json

Generated File

Complete Cap Elimination

A more comprehensive approach would eliminate the salary cap entirely, subjecting all earned income to Social Security taxes 3134. This would generate an estimated $293 billion in additional annual revenue and could close nearly 95% of the program’s long-term deficit. However, this approach would affect all 6% of workers earning above the current cap, not just the highest earners.

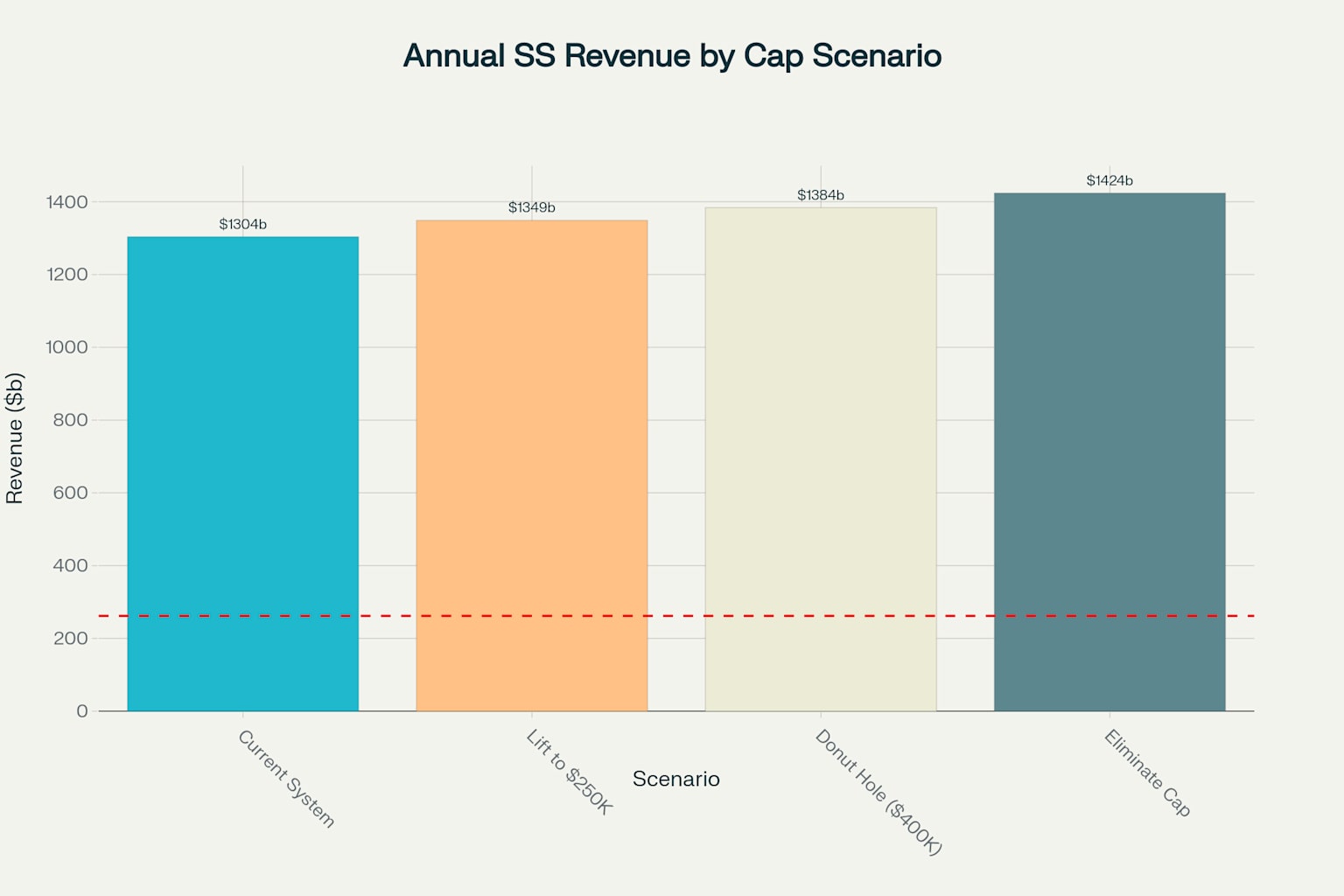

Potential Revenue Impact of Lifting the Social Security Cap

Revenue Impact and Deficit Closure

The financial impact of lifting the salary cap is substantial and could dramatically improve Social Security’s long-term outlook. Current Social Security revenue from payroll taxes totals approximately $1.3 trillion annually 35. Even modest increases to the cap could generate significant additional funding.

Analysis of different scenarios shows that lifting the cap to $250,000 could add $45 billion annually, while the donut hole approach could add $80 billion and complete cap elimination could add $120 billion.

revenue_scenarios.csv

Generated File

These increases represent meaningful progress toward closing the $262 billion annual deficit the program currently faces.

The compound effect over 75 years is even more impressive. The donut hole approach alone could generate an additional $6 trillion over the full projection period, significantly reducing the $23 trillion long-term deficit. This demonstrates that targeted tax increases on high earners could preserve benefits for all Americans without requiring painful cuts.

Who Would Pay: Impact on Different Income Groups

The proposed changes would affect only the highest-earning Americans while leaving middle-class workers untouched. Under the donut hole approach, only households earning more than $400,000 annually would see any tax increase 4749. This represents approximately 1.8% of all households, based on IRS data showing that the top 1% threshold nationally is around $653,000 1832.

For perspective, a household earning $1 million annually would pay an additional $37,200 in Social Security taxes under the donut hole approach (6.2% of the $600,000 above $400,000). While significant in absolute terms, this represents just 3.7% of their total income and is comparable to what middle-class families already pay as a percentage of their earnings.

The progressive nature of these changes aligns with public opinion. Polling consistently shows that 68% of Americans support raising taxes on high earners to protect Social Security, and 86-89% support the donut hole approach specifically 4947.

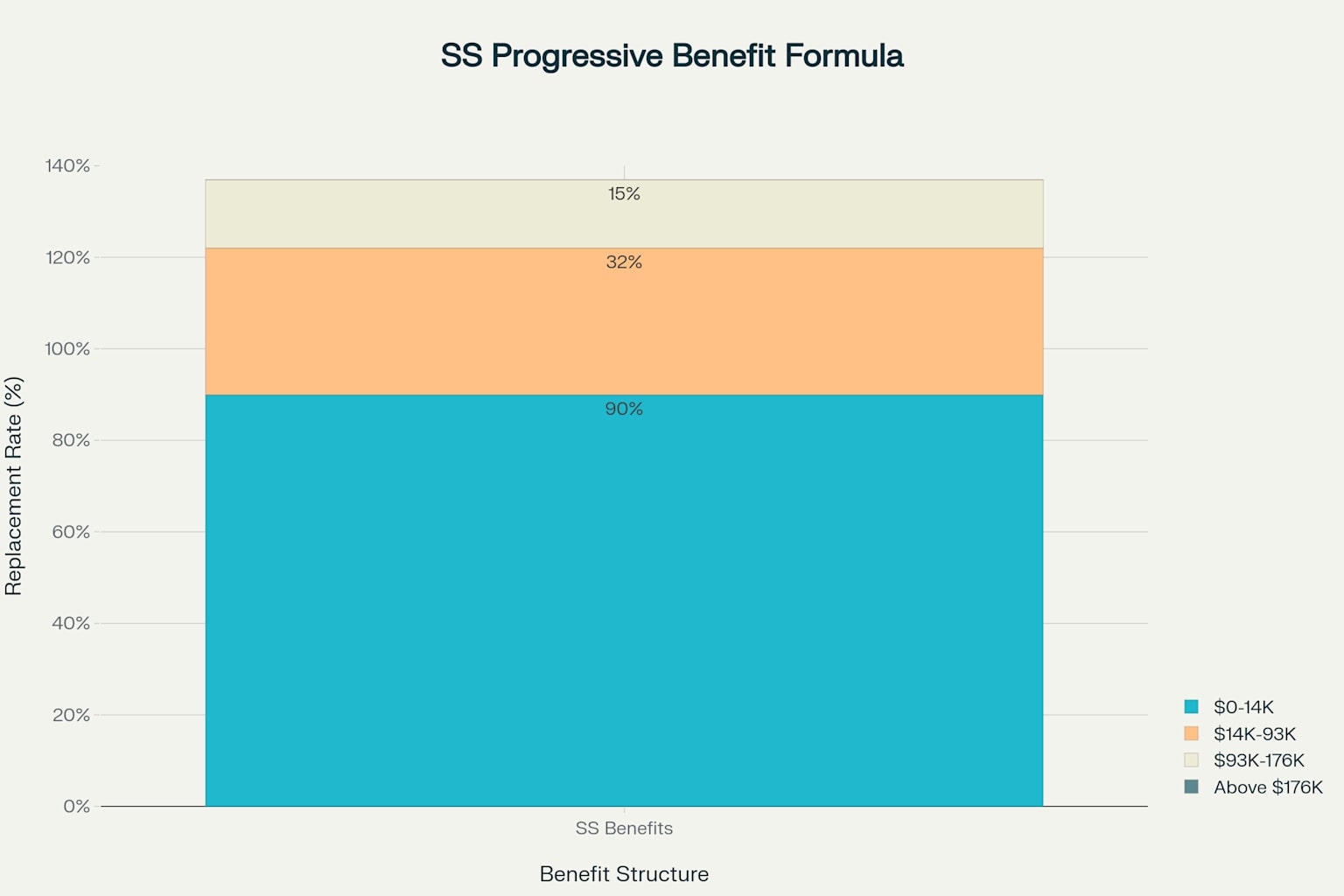

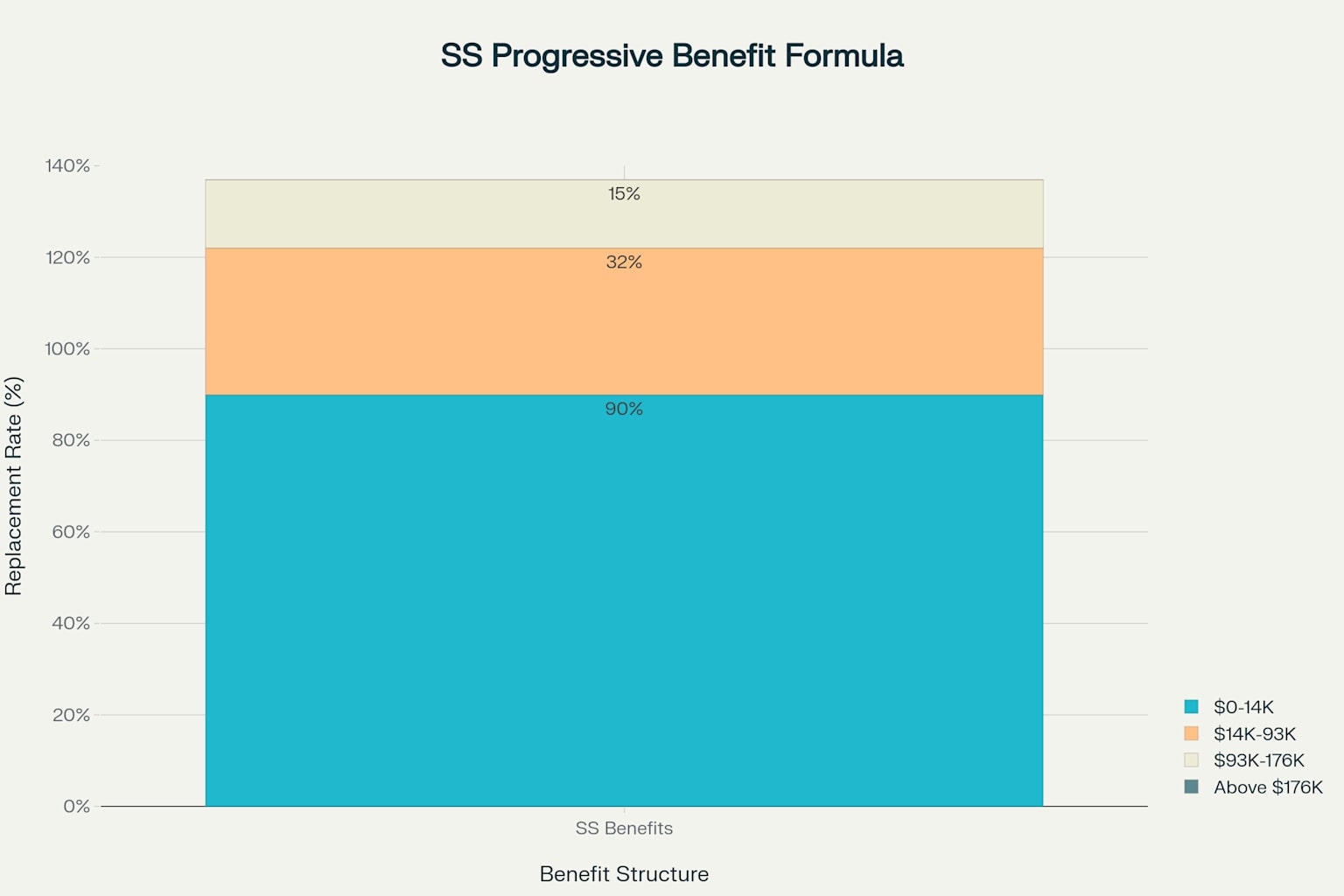

The Benefits Structure Remains Progressive

Critics sometimes argue that lifting the cap without providing proportional benefits would fundamentally alter Social Security’s character as a social insurance program. However, Social Security already incorporates significant progressivity through its benefit formula, which provides higher replacement rates for lower lifetime earnings 2752.

Social Security’s Progressive Benefit Formula Shows Fairness

The current benefit formula applies replacement rates of 90% to the first $1,174 of average monthly earnings, 32% to earnings between $1,174 and $7,750, and only 15% to higher earnings up to the cap 52. This progressive structure ensures that Social Security serves as both insurance and a foundation of retirement security, with lower-income workers receiving proportionally higher benefits relative to their contributions.

Economic Justice and Fiscal Responsibility

Lifting the salary cap represents both economic justice and fiscal responsibility. The current system allows the highest earners to avoid paying Social Security taxes on the vast majority of their income while middle-class families pay the full rate on every dollar they earn 3031. This regressive structure is particularly problematic given rising income inequality and the concentration of wage growth among top earners.

The Economic Policy Institute found that wage growth for the top 1% of earners significantly outpaced average wage growth, meaning an increasing share of total earnings escapes Social Security taxation 30. This trend undermines the program’s financing just when demographic pressures are intensifying.

From a fiscal perspective, lifting the cap offers a sustainable solution that avoids painful benefit cuts or broad-based tax increases. Rather than asking all Americans to sacrifice, these proposals focus additional contributions on those most able to afford them while preserving benefits for current and future retirees.

Conclusion: A Fair Path Forward

Social Security’s financing crisis demands immediate action, but the solution need not involve devastating benefit cuts for millions of Americans. Lifting the salary cap offers a targeted, fair approach that could preserve the program’s solvency while asking only the highest earners to contribute their fair share.

The evidence is clear: modest changes to how we tax high earners could generate hundreds of billions in additional revenue and close the vast majority of Social Security’s funding gap. The donut hole approach, in particular, offers a politically viable path that affects less than 2% of households while protecting benefits for 67 million current beneficiaries and millions more future retirees.

The choice before policymakers is stark. They can either allow automatic benefit cuts to devastate retirees in 2033, or they can act now to ensure Social Security’s long-term viability through targeted revenue increases on those most able to afford them. The financial analysis demonstrates that the latter approach is not only feasible but could largely solve the crisis while maintaining the program’s progressive character and broad public support.

Social Security has served as America’s most successful anti-poverty program for nearly 90 years 39. With thoughtful reforms to the salary cap, it can continue protecting Americans’ retirement security for generations to come. The time for action is now, before the trust fund crisis becomes unavoidable and more drastic measures become necessary.

Citations:

- https://www.investopedia.com/2021-social-security-tax-limit-5116834

- https://www.ssa.gov/oact/cola/cbb.html

- http://larson.house.gov/media-center/in-the-news/many-rich-americans-have-already-paid-their-2025-social-security-taxes

- https://www.ssa.gov/faqs/en/questions/KA-02387.html

- https://www.doeren.com/viewpoint/social-security-wage-base-increases-for-2025

- https://www.pgpf.org/article/how-does-social-security-work/

- https://www.crfb.org/blogs/cbos-options-improve-social-security-solvency

- https://smartasset.com/taxes/all-about-the-fica-tax

- https://www.brightmine.com/us/resources/talent-management/2025-wage-cap-for-social-security/

- https://taxpolicycenter.org/briefing-book/what-are-social-security-trust-funds-and-how-are-they-financed

- https://www.pgpf.org/article/without-reform-social-security-could-become-within-the-next-decade/

- https://www.ssa.gov/pubs/marketing/fact-sheets/will-social-security-be-there-for-me.pdf

- https://www.ssa.gov/policy/trust-funds-summary.html

- https://states.aarp.org/west-virginia/social-security-trust-funds-could-run-short-by-2034-as-pandemic-takes-toll

- https://401kspecialistmag.com/social-security-trust-funds-will-be-exhausted-by-fy-2034-cbo/

- https://www.americanactionforum.org/insight/highlights-of-cbos-2024-long-term-social-security-projections/

- https://www.city-journal.org/article/raising-the-tax-cap-cannot-save-social-security

- https://smartasset.com/data-studies/top-1-percent-income-2023

- https://www.ssa.gov/oact/trsum/

- https://crr.bc.edu/social-securitys-financial-outlook-the-2024-update-in-perspective/

- http://larson.house.gov/issues/social-security-2100-act

- https://www.youtube.com/watch?v=W413XT2Z1rU

- https://www.opportunityinstitute.org/blog/post/congress-scrap-the-cap-social-security/

- https://retiredamericans.org/representative-larson-introduces-social-security-expansion-bill-with-194-co-sponsors/

- https://www.ssa.gov/benefits/retirement/planner/maxtax.html

- https://www.heritage.org/social-security/report/the-impact-removing-social-securitys-tax-cap-wages

- https://budgetmodel.wharton.upenn.edu/issues/2019/9/24/the-social-security-2100-act-updated-analysis-of-effects-on-social-security-finances-and-the-economy

- https://crr.bc.edu/the-2023-social-security-2100-act-is-a-bad-version-of-a-great-bill/

- https://www.ssa.gov/policy/docs/population-profiles/tax-max-earners.html

- https://www.epi.org/blog/a-record-share-of-earnings-was-not-subject-to-social-security-taxes-in-2021-inequalitys-undermining-of-social-security-has-accelerated/

- https://www.cbsnews.com/news/social-security-benefits-tax-cap-2023/

- https://www.unbiased.com/discover/banking/how-much-income-puts-you-in-the-top-1-5-or-10

- https://www.pgpf.org/article/should-we-eliminate-the-social-security-tax-cap-here-are-the-pros-and-cons/

- https://manhattan.institute/article/problems-with-eliminating-the-social-security-tax-cap

- https://www.cbo.gov/system/files/2025-05/61386-Social-Security.pdf

- https://www.pgpf.org/article/social-security-reform-options-to-raise-revenues/

- https://www.fiscal.treasury.gov/files/reports-statements/financial-report/2024/social-insurance.pdf

- https://www.investopedia.com/social-security-payment-schedule-5213627

- https://www.census.gov/library/stories/2024/06/elder-poverty.html

- https://www.cbo.gov/budget-options

- https://www.cato.org/blog/5-good-cbo-options-reduce-federal-deficit

- https://www.reddit.com/r/MiddleClassFinance/comments/1boekwm/social_security_wage_statistics_2022/

- https://usafacts.org/answers/what-is-the-income-of-a-us-household/country/united-states/

- https://www.epi.org/publication/causes-of-wage-stagnation/

- https://www.pgpf.org/article/76-options-for-reducing-the-deficit/

- https://www.ssa.gov/oact/cola/awidevelop.html

- https://finance.yahoo.com/news/donut-hole-social-security-proposal-114200941.html

- https://www.thinkadvisor.com/2022/10/03/whats-up-with-the-social-security-donut-hole/

- https://www.fingerlakes1.com/2025/05/13/social-security-tax-plan-wealthy-2025/

- https://www.vox.com/policy/377666/social-security-reform-solvency-trust-fund-trump-harris-plans

- https://bipartisanpolicy.org/blog/social-security-autopilot-heading-toward-cliff/

- https://www.youtube.com/watch?v=g-3kOZr24zg

- https://www.aarp.org/social-security/trust-fund-shortfall/

- http://larson.house.gov/media-center/press-releases/rules-committee-republicans-block-larson-amendment-enhance-social

- https://www.cbo.gov/budget-options/60955

- https://www.cbo.gov/publication/60679

- https://www.cbo.gov/publication/60557

- https://budgetmodel.wharton.upenn.edu/issues/2020/3/6/biden-social-security

Answer from Perplexity: pplx.ai/share

Comments are closed.