The trajectory of the U.S. national debt is a compelling narrative that mirrors the nation’s evolving priorities, polarities, challenges, and triumphs. From the nascent days of the republic, grappling with the financial aftermath of the Revolutionary War, to the expansive fiscal policies of the 20th century, each era offers a unique lens into the economic and political forces at play in the history of the national debt.

In the late 18th century, under the stewardship of Alexander Hamilton, the United States established its first national debt—a strategic move to unify the fledgling states and build creditworthiness. The 19th century witnessed fluctuations driven by events such as the Civil War, which necessitated unprecedented borrowing, followed by periods of aggressive debt reduction during peacetime.

The 20th century introduced complexities with global conflicts like World War I and WWII, the Great Depression, and the Cold War, each leaving indelible marks on the nation’s fiscal landscape. Post-World War II prosperity facilitated debt reduction, but subsequent decades saw increases due to military engagements, economic policies, and social programs.

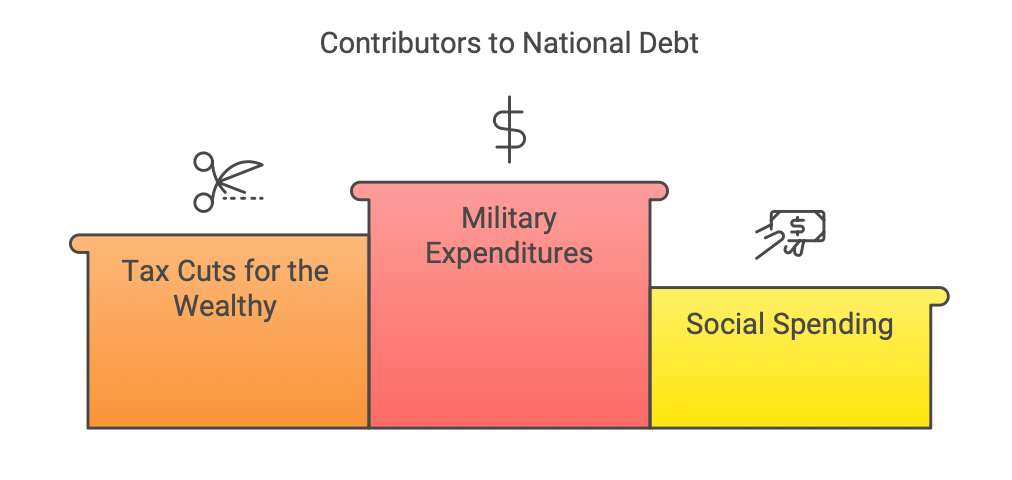

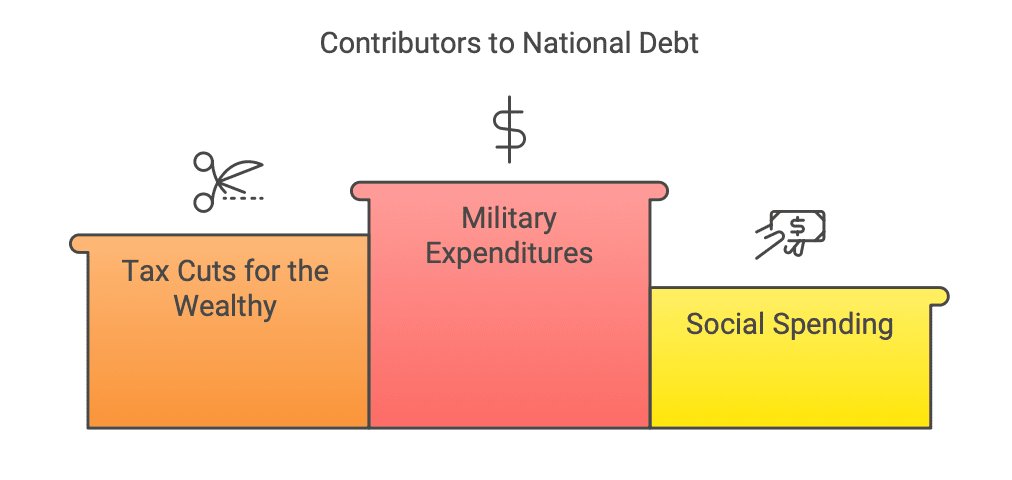

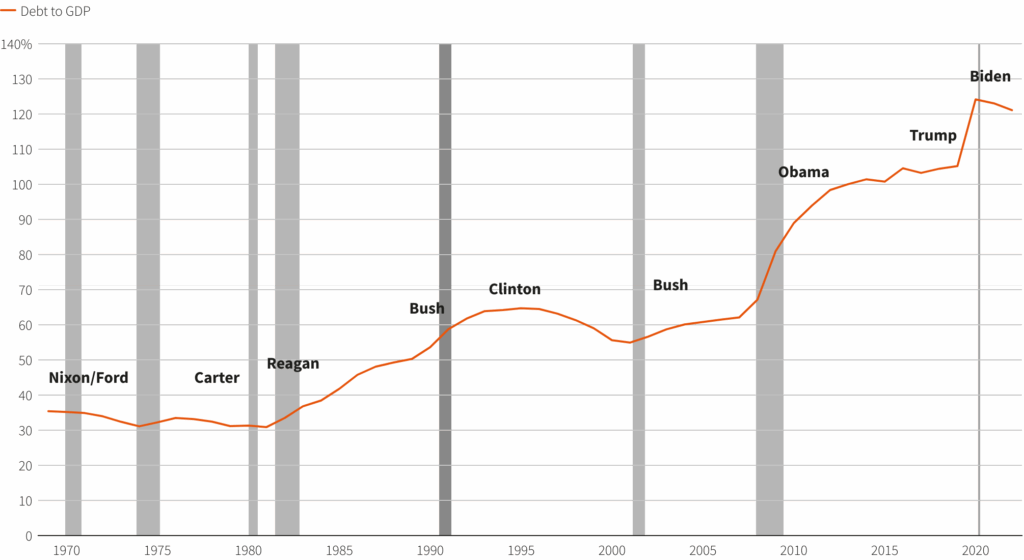

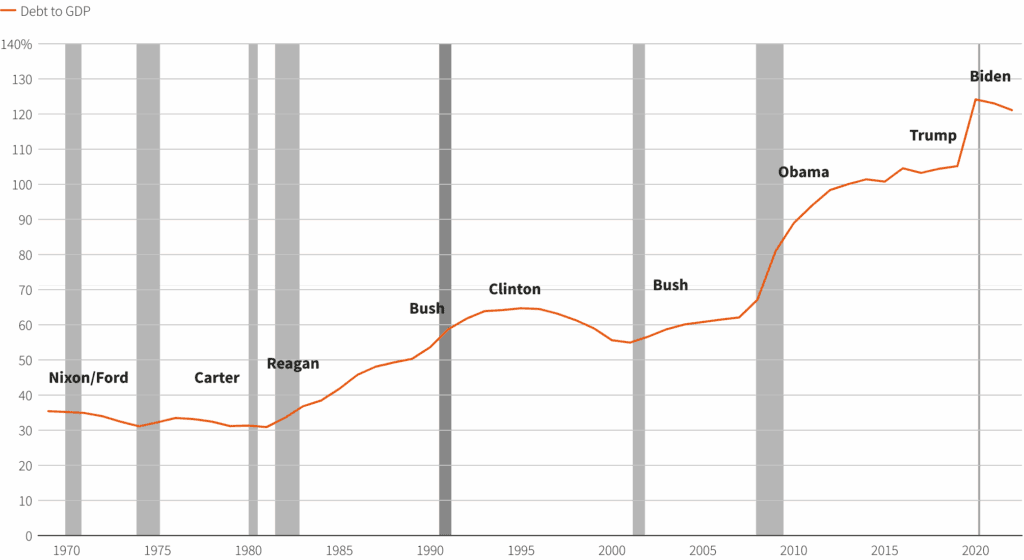

As we navigate the 21st century, the national debt continues to be a focal point of economic discourse, influenced by factors ranging from tax policies to global pandemics. Tax cuts for the wealthy under Reagan, the Bushes, and most notably Trump since 1980 have blown a hole in the debt. Military adventurism around the world including 2 completely unpaid for Gulf Wars in the ’90s and 2000s and the 20-year war in Afghanistan ballooned it as well.

This timeline delves into the pivotal moments that have shaped the U.S. national debt, offering insights into the decisions and events that have influenced its rise and fall over the centuries — so we can get intimately familiar with which policies increase or decrease it.

Summary: The 18th Century (1789–1799)

- The U.S. began with no national debt in 1789 but quickly accumulated it during the Revolutionary War and early nation-building.

- Alexander Hamilton, the first Secretary of the Treasury, laid the groundwork for managing the debt.

- By the end of the century, the debt had declined due to early repayment efforts.

18th Century Timeline

- 1789 (George Washington)

- Debt: $0 (new nation).

- The U.S. Constitution was ratified, and Alexander Hamilton was tasked with organizing the nation’s finances.

- 1790

- Debt: $75 million (approx.).

- Hamilton’s “First Report on Public Credit” proposed assuming state debts incurred during the Revolutionary War, creating the first national debt.

- 1795

- Debt: $80 million.

- The federal government issued bonds to fund debts, resulting in modest growth.

- 1799

- Debt: $82 million.

- Federal excise taxes (including the controversial whiskey tax) generated revenue, but repayment was slow.

Summary: The 19th Century (1800–1899)

- Early 19th century: Presidents like Thomas Jefferson worked aggressively to reduce the debt, nearly eliminating it by 1835 under Andrew Jackson.

- Mid-century: The debt ballooned during the Civil War to finance Union efforts.

- Late 19th century: The debt declined due to post-war economic growth and repayment policies.

19th Century Timeline

- 1800 (John Adams)

- Debt: $83 million.

- Policies emphasized debt repayment, and tariffs provided steady revenue.

- 1803 (Thomas Jefferson)

- Debt: $77 million.

- The Louisiana Purchase cost $15 million but was funded primarily through bonds.

- 1812–1815 (James Madison, War of 1812)

- Debt: $127 million (by 1815).

- The U.S. borrowed heavily to finance military efforts against Britain.

- 1835 (Andrew Jackson)

- Debt: $0.

- Jackson paid off the national debt entirely, the only time in U.S. history. Surplus revenues from land sales helped achieve this.

- 1861–1865 (Abraham Lincoln, Civil War)

- Debt: $2.7 billion (1866).

- The Civil War required massive borrowing through bonds and new taxes.

- 1899 (William McKinley)

- Debt: $2.1 billion.

- Debt declined as the government ran surpluses due to strong economic growth and high tariffs.

Summary: The 20th Century (1900–1999)

- Early 20th century: Debt grew modestly during World War I.

- Mid-century: The Great Depression and World War II saw debt soar to unprecedented levels.

- Late century: Post-war prosperity and tax reforms initially reduced debt, but deficits rose again in the 1980s and 1990s.

20th Century Timeline

- 1907 (The Panic of 1907, Theodore Roosevelt)

- Debt: $2.5 billion.

- A major financial panic prompted government interventions, but economic recovery kept debt growth modest.

- 1914–1918 (World War I, Woodrow Wilson)

- Debt: $25 billion (1919).

- Liberty Bonds financed the war, drastically increasing debt.

- The Federal Reserve was established to stabilize the banking system, increasing federal capacity to manage debt and economic crises.

- 1930s (Great Depression, Franklin D. Roosevelt)

- Debt: $40 billion (1939).

- New Deal programs required increased government borrowing.

- 1941–1945 (World War II, Franklin D. Roosevelt)

- Debt: $260 billion (1946).

- War spending caused debt to skyrocket. By 1946, debt equaled 119% of GDP.

1945–1980: Post-War Prosperity, Cold War, and Social Program Expansion

1945–1960: Post-War Debt Reduction and the Start of the Cold War

- 1945 (Harry S. Truman)

- Debt: $260 billion (119% of GDP).

- At the end of WWII, the national debt was the highest it had ever been as a percentage of GDP due to massive war spending. However, strong economic growth and limited government spending in the late 1940s helped reduce debt relative to GDP.

- 1947 (Truman Doctrine)

- Debt: $258 billion.

- The U.S. initiated its policy of containment against Soviet communism, marking the start of Cold War-related expenditures.

- 1950–1953 (Korean War)

- Debt: $273 billion (1953).

- The Korean War required significant military spending, leading to a moderate increase in debt. However, high post-war economic growth allowed the debt-to-GDP ratio to decline.

- 1955 (Dwight D. Eisenhower)

- Debt: $272 billion.

- Eisenhower emphasized balanced budgets but maintained defense spending for Cold War deterrence, including the construction of the interstate highway system.

- 1960 (Eisenhower)

- Debt: $286 billion (54% of GDP).

- Although nominal debt grew slightly, GDP growth outpaced debt growth, reducing its relative burden.

1960–1970: Kennedy and Johnson’s Social Programs and Vietnam War

- 1961 (John F. Kennedy)

- Debt: $289 billion.

- Kennedy implemented modest increases in government spending to stimulate economic growth and launched programs like the Peace Corps.

- 1964 (Lyndon B. Johnson, Great Society)

- Debt: $311 billion.

- Johnson launched the Great Society programs, including Medicare and Medicaid, alongside the War on Poverty. These expanded federal spending but were initially manageable due to strong economic growth.

- 1965–1973 (Vietnam War)

- Debt: $458 billion (1973).

- The Vietnam War resulted in a substantial increase in military spending. Combined with Great Society programs, this marked the first time significant deficits reappeared since WWII.

- 1969 (Nixon, Balanced Budget)

- Debt: $353 billion (39% of GDP).

- Nixon achieved a balanced budget by cutting spending and benefiting from strong economic growth.

1970–1980: Stagflation, Oil Crises, and Rising Debt

- 1971 (Nixon, End of Gold Standard)

- Debt: $398 billion.

- Nixon ended the Bretton Woods system, detaching the U.S. dollar from gold. This increased monetary flexibility but also contributed to inflation in the 1970s.

- 1973–1974 (First Oil Crisis)

- Debt: $475 billion (1974).

- The Arab oil embargo caused a recession and inflation (“stagflation”), reducing revenues and increasing deficits. Government borrowing grew to fund social programs and unemployment benefits.

- 1976 (Gerald Ford)

- Debt: $620 billion.

- Ford struggled to control inflation and deficits, which were exacerbated by the aftermath of the oil crisis.

- 1979 (Jimmy Carter, Second Oil Crisis)

- Debt: $827 billion.

- The second oil crisis caused another spike in inflation and stagnation. Interest payments on the national debt rose sharply, adding to the debt burden.

- 1980 (Carter)

- Debt: $908 billion (32% of GDP).

- By 1980, the debt was rising nominally but remained moderate relative to GDP due to inflationary growth. However, the economic malaise of the late 1970s set the stage for a new era of “supply-side” fiscal policy under Ronald Reagan.

- 1981–1989 (Ronald Reagan)

- Debt: $2.9 trillion (1989).

- Tax cuts, defense spending, and economic growth led to large deficits.

- 1989–1993 (George H. W. Bush)

- Debt: $4.41 trillion (1993).

- Recession, Gulf War spending, and a financial bailout caused significant increases in the national debt.

- 1993-99 (Bill Clinton)

- Debt: $5.5 trillion.

- Budget Clinton balanced the budget for the first time in decades, and surpluses briefly reduced deficits.

Summary: The 21st Century (2000–Present)

- Debt growth accelerated due to the War on Terror, the Great Recession, and COVID-19.

- Key drivers included tax cuts, economic stimulus programs, and military spending.

21st Century Timeline

- 2001–2008 (George W. Bush)

- 2009–2016 (Barack Obama)

- Debt: $19 trillion (2016).

- Economic stimulus packages from the Great Recession and the Affordable Care Act contributed to debt growth.

- 2020–2021 (COVID-19 Pandemic, Donald Trump / Joe Biden)

- Debt: $28.4 trillion (2021).

- Trump’s 2017 tax cuts followed by pandemic relief spending caused record deficits.

- 2023 (Joe Biden)

- Debt: $33 trillion (approx.).

- Interest rates and mandatory spending on Social Security and Medicare keep debt on a rising trajectory.

Comments are closed.