A national banking crisis in America that eventually spread to threaten economies around the globe, the economic crisis of 2007-8 was precipitated by the financial industry getting deeper and deeper into highly leveraged risk with a specific type of financial product called a subprime mortgage.

The loans were not of very high quality, due to the effects of predatory lending and of companies “pushing their luck” in a deregulated market by knowingly offering mortgage credit to Americans who couldn’t really afford to buy the homes they were encouraged to purchase. Mortgage underwriters were often incentivized with large bonuses for subprime signups, and even relatively well-off home buyers were often shepherded into subprime loans with worse terms than the traditional 30-year mortgages they would have qualified for.

Financial “hot potato”

The mortgages were securitized as complicated new types of assets, re-packaged into large bundles of derivatives to better obscure the sources, and rated far more favorably than warranted by the nation’s credit rating agencies. Sold swiftly around the world and especially here in the U.S. to institutional investors (who manage, among other securities, the pensions and retirement funds of the country), the game of financial “hot potato” ensured that almost no one in the complex chain of exchange had any incentive to take responsibility for the actual solvency of the underlying loans.

Eventually, the bubble popped and the house of cards came tumbling down. The downturn is widely regarded as the worst economic disaster in American history since the Great Depression of the 1930s, brought on by the stock market crash of 1929.

Moral hazard: Does commercial and investment banking under one roof create the wrong incentive?

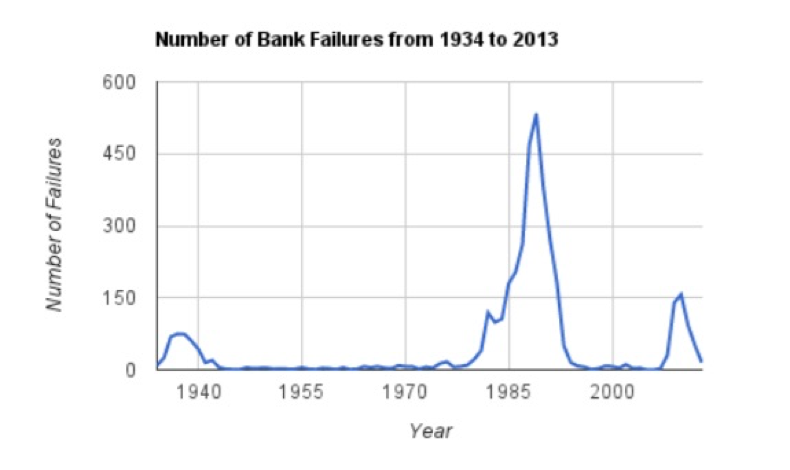

In post-recovery, much scrutiny remains over the question of whether one specific law — the Glass-Steagall Act of 1933 which separated commercial banking from investment banking in response to the Great Depression — should be reinstated. Following its passage, the U.S. was able to stop the previous historical cycle of banking crises with regularity about every ~15 years:

…Until “stagflation” (high inflation coupled with stagnant growth) plagued the American economy in the 1970s, and the political establishment began to adopt policies heavily influenced by Milton Friedman and the Chicago School of economic thought, which borrowed heavily from an earlier wave of economic philosophy in the 1930s loosely congealed under the term “neoliberalism.” Widespread financial deregulation ensued, leading to the full repeal of Glass-Steagall in 1999. Many economists now point to the deregulation spree as the ultimate cause of the 2007-8 financial crash.

For a great resource on this, check out Matt Taibbi (of Rolling Stone fame)’s book Griftopia: A Story of Bankers, Politicians, and the Most Audacious Power Grab in American History