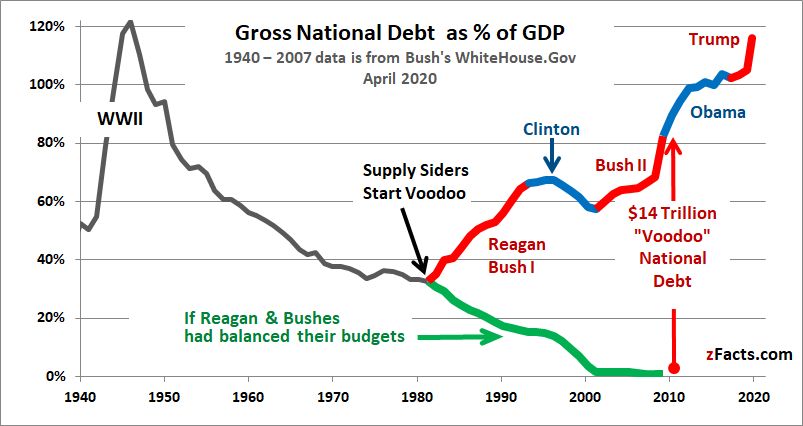

Dark money refers to political spending by organizations that are not required to disclose their donors or how much money they spend. This allows wealthy individuals and special interest groups to secretly fund political campaigns and influence elections without transparency or accountability.

The term “dark money” gained prominence after the 2010 Supreme Court decision in Citizens United v. Federal Election Commission. In that case, the Court ruled that corporations and unions could spend unlimited amounts of money on political campaigns, as long as the spending was not coordinated with a candidate’s campaign.

This decision opened the floodgates for massive amounts of dark money to flow into political campaigns, often with no way for the public to know who was behind it. Dark money can come from a variety of sources, including wealthy individuals, corporations, trade associations, and non-profit organizations.

Hidden donors

Non-profit organizations, in particular, have become a popular way for donors to hide their political contributions. These organizations can operate under section 501(c)(4) of the tax code, which allows them to engage in some political activity as long as it is not their primary purpose. These groups are not required to disclose their donors, which means that wealthy individuals and corporations can funnel unlimited amounts of money into political campaigns without anyone knowing where the money came from.

Another way that dark money is used in politics is through “shell corporations.” These are companies that exist solely to make political donations and are often set up specifically to hide the identity of the true donor. For example, a wealthy individual could set up a shell corporation and then use that corporation to donate to a political campaign. Because the corporation is listed as the donor, the individual’s name does not appear on any public disclosure forms.

The money can be used to run ads, create content and propaganda, fund opposition research, pay armadas of PR people, send direct mail, lobby Congress, hire social media influencers, and many other powerful marketing strategies to reach and court voters.

These practices erode at the foundations of representative democracy, and the kind of government the Founders had in mind. One is free to vote for who one wishes, and to advocate for who ones wishes to hold power, but one has no Constitutional right to anonymity when doing so. It infringes on others peoples’ rights as well — the right to representative and transparent government.

Dark money impact

Dark money can have a significant impact on elections and public policy. Because the source of the money is not known, candidates and elected officials may be influenced by the interests of the donors rather than the needs of their constituents. This can lead to policies that benefit wealthy donors and special interest groups rather than the broader public.

There have been some efforts to increase transparency around dark money. For example, the DISCLOSE Act, which has been introduced in Congress several times since 2010, would require organizations that spend money on political campaigns to disclose their donors (the acronym stands for “Democracy Is Strengthened by Casting Light On Spending in Elections”). However, these efforts have been met with resistance from groups that benefit from the lack of transparency — who, somewhat ironically, have been using their influence with the Republican Party to make sure the GOP opposes the bill and prevents it from passing, or even coming up for a vote at all.

In addition to the impact on elections and policy, dark money can also undermine public trust in government. When voters feel that their voices are being drowned out by the interests of wealthy donors and special interest groups, they may become disillusioned with the political process and less likely to participate.

Overall, dark money is a significant problem in American politics. The lack of transparency and accountability around political spending allows wealthy individuals and special interest groups to wield undue influence over elections and policy. To address this problem, it will be important to increase transparency around political spending and reduce the influence of money in politics.

Dark Money: Learn more

- Koch Wealth Cult

- Heritage Foundation

- Federalist Society

- Council for National Policy

- ALEC

- NRA

- Charles Koch

- Richard Mellon Scaife

- Joseph Coors

- Betsy DeVos

- Peter Thiel