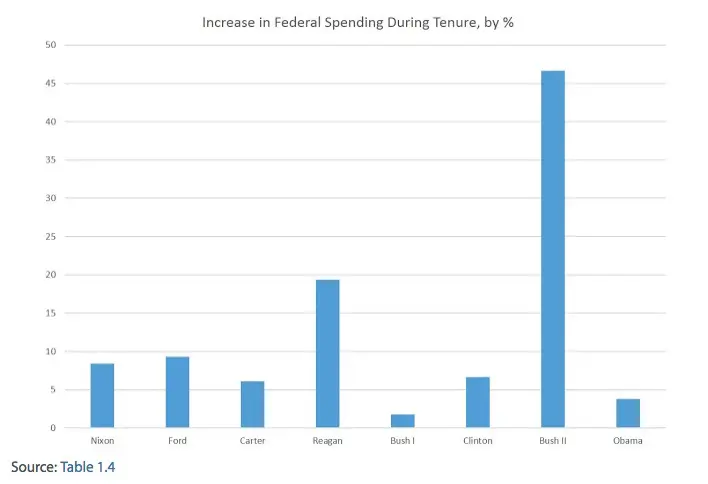

Regardless of whether or not you agree that slashing spending, fiscal austerity, balanced budgets, and a low federal deficit are good ideas, the fact remains that the Republican Party does not generally live up to its aims of expense reduction and small government.

As hard as it is to believe, there are still some people who think that Reagan cut the size of government, although Reagan was a big spender and laid the groundwork for the immense national debt we live with today.

(even the Austrian School agrees)

Then there was Ol’ Dubya with his two disgraceful wars, TARP bailout, auto bailouts, fiscal stimulus, and tax cuts. Not to mention yanking the election out from under Al Gore’s popular win via a leg up from Florida governor brother Jeb.

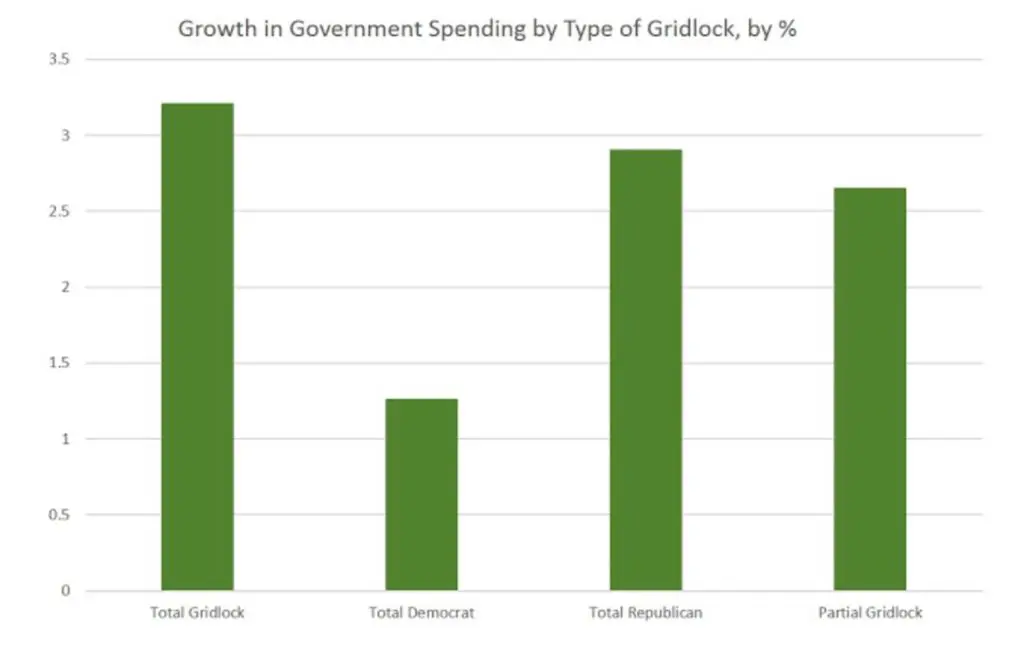

Turns out, not even gridlock is a decent strategy for preventing escalating expenditures, under the theory that not getting anything done would prevent the government from growing. Apparently not:

“Gridlock” in DC Does Little to Stymie Government Spending

Total gridlock is the worst outcome, where impact to the budget is concerned. Total Democratic control of the White House and Congress is the most fiscally responsible since the presidency of Richard Nixon.

So the idea of Republican leanness is a fallacy whether you believe that’s a worthy goal or not — and there’s a lot of evidence to suggest the tide is turning toward a wider appreciation of John Maynard Keynes’ approach to sensible fiscal spending when there is unemployment (puts idle resources to work and reduces government welfare expense; gives people a sense of purpose; builds community), if it is accomplished by debt financing (i.e., issuing Treasury Bonds — allowing individuals, pension funds, and so on to invest in the United States as sort of national asset class) and is used to build goods and structures that benefit the public at large: infrastructure, research and development, public resources, public health services, job training, paid volunteer work, parks and public spaces, etc.

Keynesian and Classical theory have oft been at odds, but are better understood now as complements: in a healthy, roaring economy, government should take its boots off the throttle and avoid tipping over into the kind of speculatory gamesmanship that got us into hot water in 2007-8. But in a depression or recession, or when the economy is recovering sluggishly, it should be a goto solution to start thinking about where to apply government funds (i.e. our money!) to things that need doing anyway; services that invest in our economy’s greatest resource: its citizens; programs that position us for the future by having the luxury to think ahead boldly.

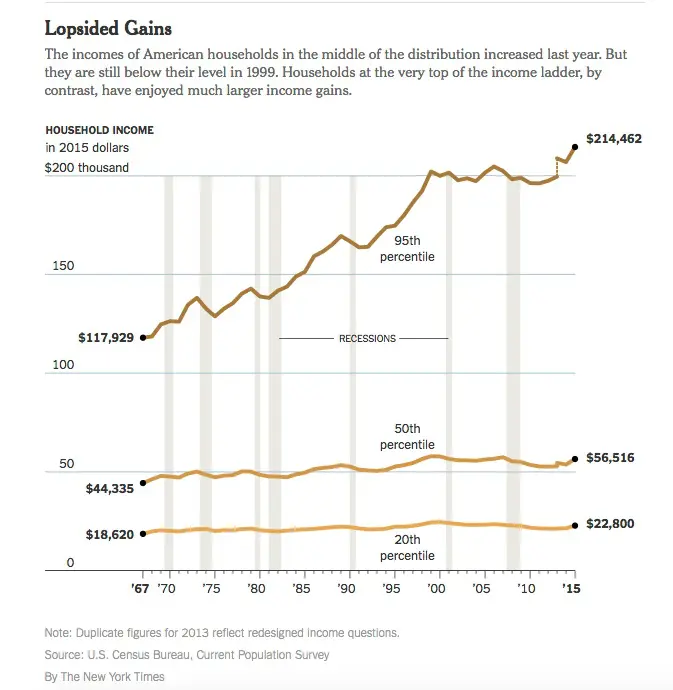

NYTimes: Real income gains are brief and hard to find

Although the economy has recovered nicely for some — especially those in higher tax brackets — it has clearly left a number of Americans behind. It’s only added to a trend that had already started in the 70s, when inequality began widening in the U.S. The populist white nationalist ire unleashed in the 2016 presidential election was something perhaps few saw coming, even though in hindsight the far right has been whipping their base into a frenzy for years — arguably since Reagan, if not with Nixon. That means there’s still a healthy place for government spending, especially in areas we already know we’re in sore need of a boost: roads and bridges, a public health care option, basic research, advanced manufacturing, the pivot to a renewable energy economy, to name a few.

Luckily, that’s what Hillary Clinton wants to do:

- Use the revenue from closing corporate loopholes and cracking down on tax inversions to invest in small business, long-term growth, R&D, advanced manufacturing, and job training

- Manufacturing Renaissance Tax Credit: to help revitalize communities hit hardest by the collapse of manufacturing

- Paid family and medical leave in the workplace

- Fundamentally reform veterans’ health care and build a 21st-century Department of Veterans Affairs to deliver world-class medical care

- Close oil and gas loopholes, using the proceeds to pay for the transition to a renewable energy economy

- Close loopholes and raise tax brackets for the very wealthy, using the funds to invest in youth services and infrastructure

- Modernize America’s energy infrastructure, address the growing threat of cyberattack, and support clean energy job creation and innovation in the process

- Create a Clean Power Market across the North American continent

- Offer competitive grants for phasing out old, polluting energy infrastructure (fuel oil, propane, coal)

- Reduce air pollution by converting / deploying high-efficiency trucks, buses, ships, and trains in the transportation sector

- Increase public R&D in renewable natural gas, low-carbon gas, and carbon dioxide sequestration

- Offer apprenticeship programs in high-skilled jobs in the new energy economy and construction

- Modernize housing policy, curb skyrockeeting rents in major cities, reforge a path to homeownership for middle America

- Create a public health care option to incentivize competition in the ACA exchanges

- Launch a national campaign to modernize and elevate the teaching profession

- Provide school district funding to develop computer science curriculum

- New municipal school bonds program to help finance repairs and re-investment in unsafe and unhealthy schools

- Offer free community college tuition and debt-free public college tuition for families who make up to $125,000/year

- Allow student loans to be refinanced at current low interest rates; forgive any debt remaining after 20 years

- 3-year student debt deferment for social entrepreneurs and eligibility for up to $17,500 in debt forgiveness

- Institute a 3-month moratorium on student loan payments to allow borrowers to consolidate and refinance

- Make preschool universal for every 4-year old in America; double investment in Early Head Start

- Increase child care investment significantly to ensure to family pays more than 10% of their income

- Double the size of the outdoor economy within 10 years, adding $700 billion in new annual economic activity

- Create an American Parks Trust Fund to invest in the country’s natural preserves

- Restore and refresh more than 3000 city parks within 10 years

- Create a new Water Innovation Lab and a Western Water Partnership to help manage our water challenges over the coming decades

- Become the world’s clean energy superpower: install more than half a billion solar panels by the end of term 1; generate enough renewable energy to power every home in American within 10 years; create a grant and award-based Clean Energy Challenge with states, cities, and rural communities; Solar X-Prize; tax incentives for renewables; foster energy innovation

- Help build the new tech economy on Main Street: create a lifelong learning system more geared towards 21st-century jobs; invest in STEM education; invest in science and tech R&D; help ensure benefits are flexible and travel with workers, not their employers; commit to 100% of households with broadband access by 2020; deploying the 5G wireless network; building free wi-fi infrastructure in punlic places and transport hubs; launch digital community projects to improve connectivity more affordably

- Offer tax credits to companies who hire apprentices

- Offer tax credits to companies who offer profit sharing programs to their employees

- Public health initiatives: substance abuse treatment and prevention; expand mental health services; services for autism spectrum disorder; reduction of co-pays and deductibles; reduce the cost of prescription drugs; double funding for community health centers

- Expand the role of national service, both paid and volunteer, with expansions of programs like the Peace Corps, AmeriCorps, Habitat for Humanity, the Red Cross, and the creation of a National Service Reserve for millions of Americans to contribute volunteer time to local challenges in their own communities

#ImWithHer

by the way: Her plan plans to finance itself by making wealthy individuals and corporations pay their fair share in taxes, and would not appreciably add to the deficit beyond any existing projections from the OMB;but here’s the best explainer I have found about why we should seriously loosen our collars over the national debt. There is no reason to pay it down; and indeed, it would be dangerous and deleterious to even try to, because we’d be starving the economy of the circulation it needs to keep operating and growing:💰money💰.

Comments are closed.